For decades, Walgreens has been a go-to for beauty buys, prescriptions, and quick essentials. But rumors of mass store closures have sparked confusion and concern. Here’s what’s really happening: Walgreens is cutting costs—aggressively. Yes, around 1,200 stores will close by 2027, and yes, it will affect how millions access care.

But not everything’s disappearing. In fact, Walgreens is slashing prices on over 1,500 items, trimming its beauty inventory, automating prescriptions with robots, and preparing to go private. The result? A leaner, tech-driven model that could reshape how millions access essential care.

But not everyone benefits equally—some communities are already losing critical pharmacy access. So, what’s really changing—and why does it matter to you?

Beauty Favorites Are Disappearing Fast

If you’ve noticed fewer beauty brands at Walgreens, you’re right—Walgreens is actively downsizing its beauty departments. Shoppers report empty shelves and missing staples like NYX, Wet n Wild, and Bioderma. Reddit threads and employee tips confirm major “category resets” are underway. Brands like Revolution are being phased out, and minimal restocks are being sent to stores.

The downsizing is part of Walgreens’ effort to streamline operations and focus on high-margin items. For beauty fans who rely on quick drugstore pickups, it may mean turning to online orders or alternative stores. But this is just the beginning of the transformation inside Walgreens stores.

Prices Are Dropping—Here’s Why

Walgreens is slashing prices on more than 1,500 items to compete with inflation-fatigued rivals. Dubbed a “summer of savings,” the move includes markdowns on everyday essentials—like Clean & Clear cleansers (now $6.99, down from $7.99) and Eucerin Advanced Repair Hand Cream (now $5.99, reduced from $7.29). It’s part of a broader pricing strategy that began in late 2023 to keep customers from fleeing to discount giants like Walmart and Amazon.

While the savings are real, they’re also strategic: lower prices could soften the blow of store closures and automation changes. But not every deal is a distraction—some shoppers are already noticing real relief in their weekly spending.

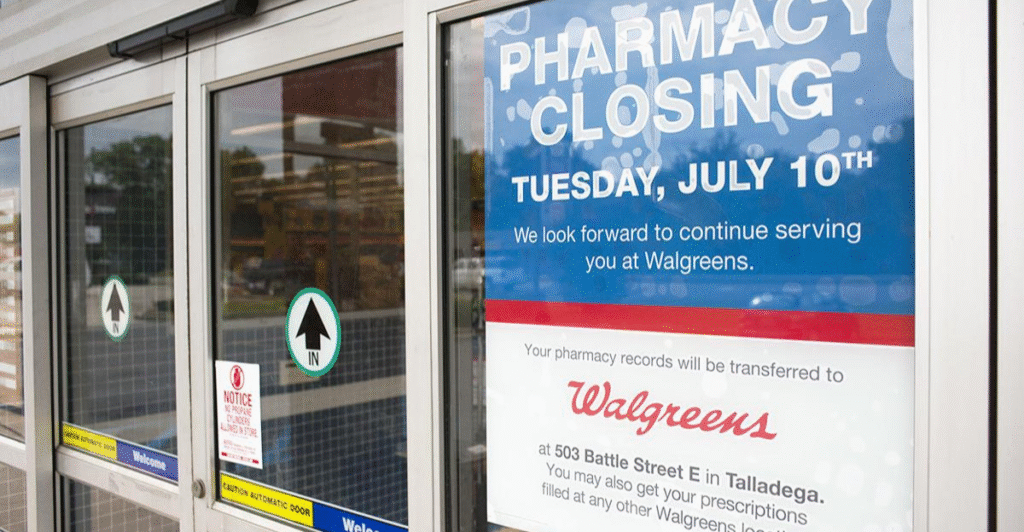

Hundreds of Stores Shutting Down

Roughly 1,200 Walgreens stores—about 14% of its U.S. footprint—are set to close by 2027. The cuts mainly target underperforming locations in urban and rural markets. Already, cities like Baltimore have seen long-standing neighborhood stores shut down, leaving locals scrambling. CEO Tim Wentworth says the focus is now on the 6,000 remaining “profitable” stores, which will receive more investment and tech upgrades.

But for many communities, especially those lacking nearby alternatives, the closures feel like abandonment. As Walgreens shrinks its retail presence, the changes are raising questions about healthcare access in areas already struggling with essential services.

The Pharmacy Desert Problem

As Walgreens exits key neighborhoods, it’s creating what experts call “pharmacy deserts”—areas where basic medication access is suddenly out of reach. These closures disproportionately impact Black, Latino, and underserved communities. In Baltimore, resident Sheila Carter shared the burden of relying on public transit to fill prescriptions.

Local leaders warn that reduced access to pharmacies could worsen chronic health issues and increase healthcare costs. One veteran described it plainly: “It’s already a food desert in this area, but now to have a medication desert is really going to be an issue.” These ripple effects go beyond convenience; they reveal deep health disparities that store closures risk making even worse over time.

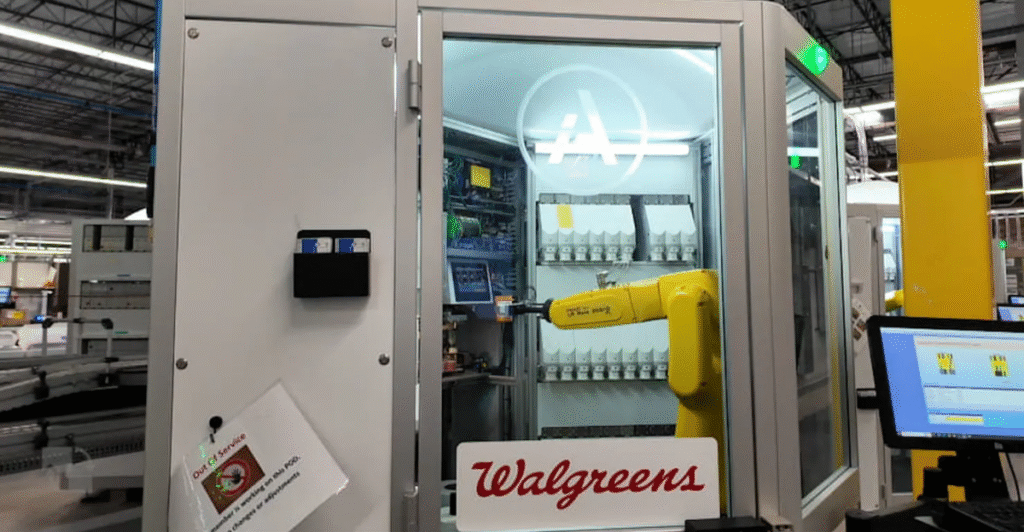

Robots Are Filling Prescription Centers Now

Automation is changing Walgreens from the inside out. Eleven high-tech fulfillment centers now use robotic systems to fill maintenance prescriptions for conditions like diabetes or high blood pressure. The shift is saving the company money—over $500 million so far—and aims to free pharmacists to spend more time with patients.

These centers now handle about 40% of prescriptions for supported stores, and that share is growing fast. The idea: speed up service, cut costs, and reduce inventory waste. But for many customers, the transition is far from seamless—and the next wave of tech isn’t just behind the scenes anymore.

Why Everything’s Behind Locked Cases Now

If you’ve noticed shampoo, deodorant, or even snacks locked behind plastic at Walgreens, it’s not your imagination. Anti-theft cases are becoming the norm, especially in urban stores. CEO Tim Wentworth admitted the downside: “When you lock things up, you don’t sell as many.” Yet retail crime and losses—known as “shrink”—remain a top concern.

Walgreens is experimenting with alternatives, but the current setup leaves shoppers frustrated. Waiting for help to unlock basic items adds time and tension to everyday errands. The company says it’s working on “creative” solutions, but for now, the customer experience continues to take a hit.

How Prescription Automation Affects You

Robotic fulfillment centers are transforming the prescription process at Walgreens. Routine meds are shipped from central hubs, giving store pharmacists more time for vaccines and consultations. Vaccination rates at supported stores have jumped 40%.

But the tech doesn’t always benefit the customer experience. Shoppers report oversized pill bottles, hard-to-read labels, and increased delays. Some complain about excessive paperwork or unclear instructions.

While the digital shift boosts efficiency on paper, it’s testing the patience of long-time customers. As Walgreens leans into this new model, it remains to be seen whether tech can truly replace the personal touch customers still expect.

Protests Are Growing Nationwide

Communities are pushing back. In Roxbury, Massachusetts, residents staged protests after Walgreens closed its fourth store in a predominantly Black Boston neighborhood. They’re not alone—local leaders and national lawmakers are raising alarms. Congresswoman Ayanna Pressley and Senators Elizabeth Warren and Ed Markey sent a formal letter to Walgreens’ CEO, calling the closures a form of “economic discrimination.” These actions underscore a growing backlash against pharmacy deserts and corporate consolidation.

But despite mounting pressure, Walgreens is sticking to its cost-cutting roadmap. As closures continue, many communities are left scrambling to find reliable access to medication, essentials, and healthcare services.

What This All Means Going Forward

Walgreens’ sweeping changes mark a turning point in how Americans access essentials. With fewer stores, tighter security, and robotic prescriptions, the chain is betting on a pharmacy-first, tech-powered future.

While some moves offer clear benefits, like lower prices and faster service, others create real barriers for vulnerable shoppers. As Walgreens prepares to go private, the retail landscape is shifting toward automation, consolidation, and digital convenience.

But access, equity, and the human side of pharmacy care remain unsettled. For millions of Americans, the cost of transformation may not be measured in dollars, but in distance, delays, and diminished trust in neighborhood care.

Discover more trending stories and Follow us to keep inspiration flowing to your feed!

Craving more home and lifestyle inspiration? Hit Follow to keep the creativity flowing, and let us know your thoughts in the comments below!