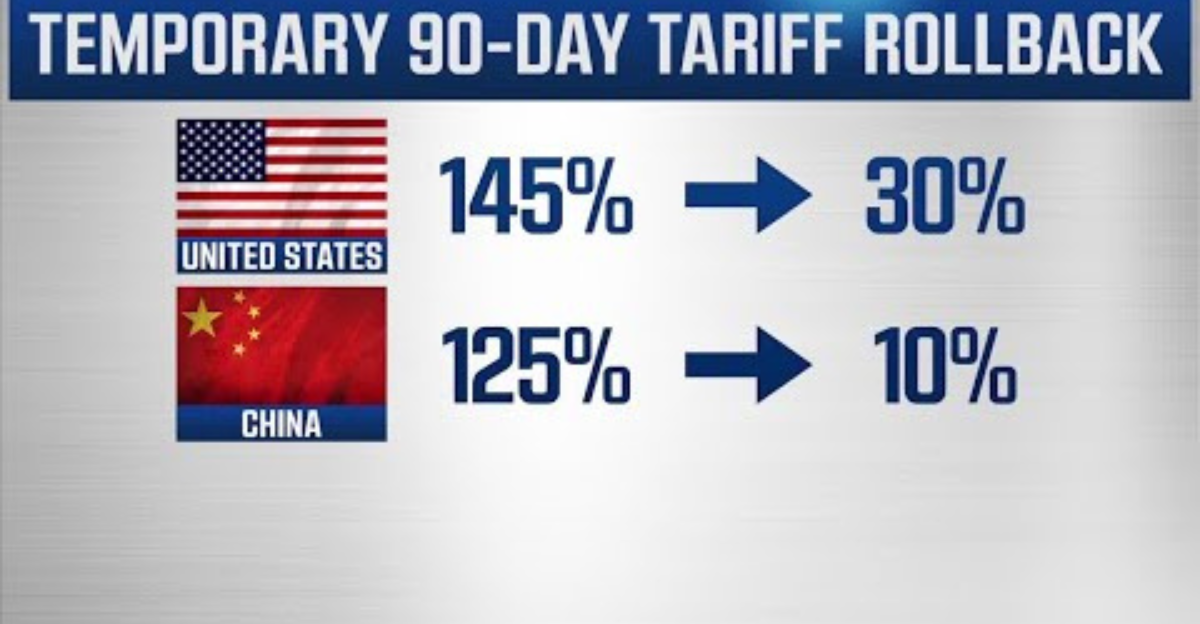

The Trump-led administration raised tariffs on Chinese imports to 145% in early April. China responded to the increased tariffs by imposing a 125% import duty on U.S. goods. At this point, the trade war was truly on. But just like it never happened, the two countries reached an unexpected agreement for a 90-day truce. The U.S. decreased tariffs on Chinese imports from 145% to 30% starting May 14, and China reduced tariffs on U.S. imports from 125% to 10%.

The move was greeted with a global market rally, and the Dow Jones surged over 1100 points. Notwithstanding, critical and fundamental issues remain unresolved, and with the clock counting down to the expiration of the 90-day window, experts and analysts are asking, “Is this a breakthrough or just a temporary bandage?” Read on as we explore that question.

What the Tariff Cut Actually Means

The trade war between these two economic behemoths resulted in significant challenges for businesses across both nations. So, the drastic (and unexpected) tariff reduction serves as an important respite for manufacturers and retailers caught in the crossfire and ensuing trade conflict.

For American companies reliant on Chinese components and goods, this window of peace will not only help them quickly source much-needed raw materials but also help stabilize supply chains. On China’s end, the reduction signals a willingness to protect its heavily export-driven economy.

90 Days of Peace or the Calm Before the Storm?

Although the U.S. and China’s 90-day tariff rollback is being hailed as a diplomatic victory, as mentioned earlier, many analysts are approaching it cautiously. The deal’s short-term nature (and historical record of failed agreements) begs important questions: Is this merely a tactical stopgap before tensions resurface, or is this the start of a longer-term resolution?

Negotiating Window…Not Resolution

For starters, neither party has yet pledged to fully remove the tariffs. Instead, both presented this ceasefire as a “negotiating window” to resolve outstanding issues, including intellectual property and technological transfers. Furthermore, even with the tariffs reduced, they are still significantly higher than pre-conflict levels. Moreover, sensitive industries that deal with fentanyl-related products are not included in the tariff reduction.

So, with that in mind, there’s the possibility that this truce may be less about real progress and more about buying time. Both governments may be employing this respite to recalibrate rather than to come to a final agreement. Therefore, tariffs could be reinstated (and maybe increased) without a real deal at the end of the ninety days.

Winners and Losers: Who Gains From the Tariff Rollback?

The tariff rollback provides instant benefits for American businesses like Apple, retail stores, and other electronics manufacturers that rely heavily on Chinese components. e-Commerce behemoths like Shein and Temu will also gain from lower import prices. China, on the other hand, has also benefited from the tariff rollback in that its exporters have regained access to American consumers (and this is a big deal considering how export-driven its economy is).

However, some businesses, like U.S. Steel and the solar industries, lose out. These sectors were shielded by the high tariffs; a footing now lost.

Fentanyl and the Opioid Exception

Despite the welcome development, several issues still remain unresolved. First, there is the problem of opioid abuse, a crisis that both countries have pledged to combat. Consequently, the U.S. has retained the tariff on fentanyl imports from China as a measure to control the looming challenges of drug abuse while a more sustainable agreement is reached.

Sensitive Sectors Still Off-Limits

Then there’s the issue of more sensitive sectors, including national security and advanced technology. These sectors do not benefit from tariff reductions, which also highlights some level of mistrust between the nations. The United States maintains tariffs on Chinese technology products such as semiconductors and advanced machinery, as these products are critical to national security interests. With these fundamental issues yet unresolved, the tariff may yet extend beyond the 90-day window. It remains to be seen.

Wall Street’s Reaction

When the tariff rollback was announced, the U.S. markets were thrown into a frenzy. Consequently, the Dow Jones rose more than 1,100 points in a single day (one of the most significant gains in recent history). This goes to show that investors are hopeful about the possibility of less economic volatility and a more secure business climate. Critics, however, cautioned that this market frenzy may be short-lived. This is because the fundamental causes of the trade war have not been resolved.

Déjà Vu: How This Mirrors Past Trade Ceasefires

Reddit – u/rezwenn

This isn’t the first time the U.S. and China have declared a tariff truce. Similar 90-day agreements were used by both parties to halt hostilities in 2018 and 2019, but negotiations broke down, and tariffs increased in intensity.

Just like with the latest agreement, earlier ceasefires provided temporary market relief but did not address the fundamental disagreements over tech transfer, intellectual property, and geopolitical rivalry. Consequently, both agreements broke down, and both nations increased tariffs. History indicates that this truce might repeat the same pattern: optimism now, escalation later, in the absence of a more comprehensive, legally binding agreement.

Is a Real Trade Deal on the Horizon?

The 90-day tariff rollback has infused some much-needed confidence into global markets, but it’s far from a definitive conclusion. Crucial issues are still left on the table, so the path to a full trade deal remains dubious.

So, in our opinion, this delay seems to be a strategic reset rather than a breakthrough for both nations. Ahead of the election season, the United States benefits from this truce. It provides short-term economic breathing room for China. However, if significant progress is not made during this window, tariffs may revert or worsen. In addition to defining trade relations between the United States and China, the next three months could also put the larger global economic system to the test. We watch with bated breath as the clock ticks down.

Discover more trending stories and Follow us to keep inspiration flowing to your feed!

Craving more home and lifestyle inspiration? Hit Follow to keep the creativity flowing, and let us know your thoughts in the comments below!