What would be your reaction when you walk into Walmart and see half the shelves half full, as if they were under normal circumstances?

It is no run-of-the-mill supply hiccup but a particular result of President Trump’s aggressive tariffs on Chinese imports in 2025. People often argue about tariffs using theoretical economic jargon; their in-the-trenches impact smites most severely at retail giants such as Walmart, which sources as much as 60% of its goods from China.

The steep tariffs, reaching up to 125%, have slashed Walmart’s Chinese inventory by 50%, triggering shortages and price hikes that ripple through American households. This story concerns the tangible cost of economic brinkmanship on everyday life more than trade policy.

The Anatomy Of A Trade War

Trump tariffs were a blunt instrument targeted at Chinese pressure, with up to 125% on commodities. Walmart, which has benefited from Chinese imports ranging from electronics to clothing, suffered.Tariffs made Walmart pay more, leading to calls from Walmart for suppliers to reduce prices by up to 10% to avoid having to pass the costs on to customers.

The Chinese government pushed back, summoning Walmart executives to object to such demands. This standoff has stretched Walmart’s supply chain, halving its Chinese inventory as shipments languished or were canceled, demonstrating how geopolitical strategies could choke corporate lifelines.

How Inventory Depletion Creates a Perfect Storm For Consumers

Walmart’s 50% decline in inventory or not is more than a figure; it translates to empty shelves and angry consumers. Experts say this condition is close to the “COVID-like” pandemic shortages that left everyday items unavailable.

Major port statistics show a 30% decline in freight receipts, showing a whole supply chain issue. The low levels force Walmart to raise prices or lose business. This situation shows how retailers must balance consumer confidence, cost, and supply during a tariff-induced supply chain and inventory disruption.

The Ripple Effect Of Walmart’s Woes For Retail and Logistics

Walmart’s inventory nightmare caused by tariffs is a warning for the retail and logistics industry. With 9 million trucking industry jobs and 16 million retail jobs on the line, layoffs are imminent as shipments decrease.

Independent retailers without Walmart’s negotiating power have even more draconian decisions, such as eating the costs or closing doors. The spillover consequences may undermine the stability of the American economy, illustrating how tariffs intended as a geopolitical tool can spill over into general economic disruption and employment loss.

Could Tariffs Stimulate Domestic Manufacturing?

One common argument supporting tariffs is that tariffs promote domestic production. Of course, although there are some dark moments to Walmart’s journey, at least the pace and scale of fighting against Chinese imports back home seem overwhelming.

Walmart’s efforts to buy differently will likely be slow and costly, and there appears to be no imminent relief. It refutes the naive textbook postulate that tariffs inevitably boost American manufacturing, but instead shows how carefully established global supply chains are resistant to rapid readjustment, leaving consumers in the middle.

How Price Increases and Shortages Erode Consumer Confidence

The tariff war takes money from people’s pockets and threatens consumers’ trust. Consumers who are used to super-low prices from Walmart now have prices and empty shelves that frustrate consumers and contribute to deepening distrust.

This cumulative psychological strain may diminish consumer spending, loyalty, the Walmart brand, and the retail economy. The implicit cost of tariffs feeds into consumer consumption, possibly changing consumer spending patterns years after the tariffs take effect.

Parallel Historical Examples Of Trade Wars Affecting Consumer Behavior In Retail

As history has shown, trade wars rarely end neatly. For example, the Smoot-Hawley Tariff of 1930 made the Great Depression worse by reducing trade and driving prices higher. Walmart’s bad fortune is similar to that of the 1930s.

We see a similar lesson: tariffs designed to protect domestic uses can backfire, causing shortages and inflation. This historical lesson reminds us of the risks of unchecked tariff policy and the benefits of prudent, thoughtful trade negotiations over tit-for-tat tariffs.

Framework For Understanding Walmart’s Stock Crisis

To understand the predicament facing Walmart, think of a “Tariff Squeeze Model”: tariffs increase the costs of imports and retailers pushback against suppliers to get concessions; suppliers will not budge due to their situation and governmental support; less or no shipments; dwindling stock or shipments; price increase; customer taste change.

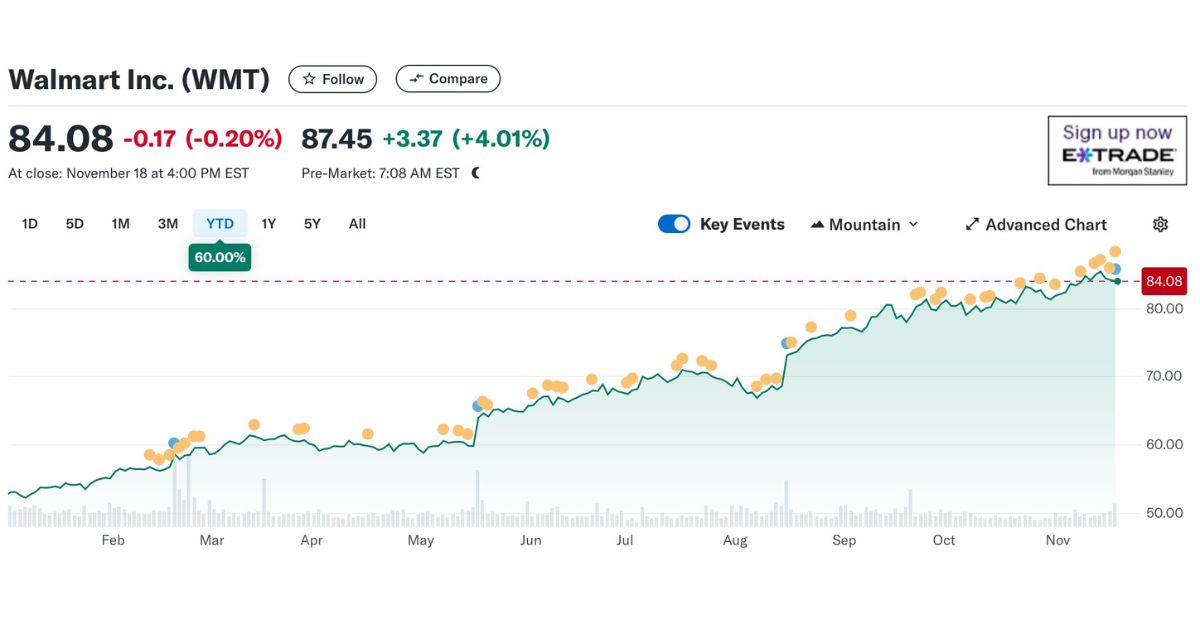

This vicious squeeze is a plausible framework for thinking about how Wal-Mart has lost half of its market capitalization and how the issue is not one of anecdote but structure. The model presumes an extended disruption ranging from a minimum of one fiscal quarter and upward if tariffs and supply chains do not disintegrate.

The Extremeness Of Walmart’s Negotiation

Walmart’s boardroom negotiations with Chinese counterparts demonstrate the geopolitical ramifications behind the products on store shelves. Unlike normal supplier disputes, the talks included a governmental presence and a “more intense” trade war.

Walmart pleads for a 10% discount on a price increase due to price gouging, but the rejection shows how national interests overshadow business strategy. This case study is a prime example of how tariffs turn business decisions into diplomatic minefields, making supply chain resilience more difficult.

Lessons From The Tariff Legacy and The Road Ahead

Trump’s tariffs have accomplished more than reducing Walmart’s inventory from China by 50%; they have revealed weaknesses in global supply chains, strained international relations, and rattled consumer confidence. The short-term consequences, bare shelves, higher prices, and job uncertainty, are precursors to longer-term economic issues if tariffs continue.

Moving forward, retailers will need to create new and alternative models for sourcing, policymakers will need to consider tariff costs versus rewards, and consumers will need to brace for a new retail reality. The Walmart case is a harsh reminder–trade wars are not theoretical battles; they are real disruptions that have long-term effects.

Discover more trending stories and Follow us to keep inspiration flowing to your feed!

Craving more home and lifestyle inspiration? Hit Follow to keep the creativity flowing, and let us know your thoughts in the comments below!