Something strange thing is happening in American industry. Experts have forecasted for years the inevitable fall of U.S. Steel—blaming foreign competition, crumbling infrastructure, and declining demand.

Wall Street didn’t bet on a return. Washington held its breath. Even the unions didn’t believe it. And then, out of nowhere, a seismic shift started taking place. A surprise $14 billion investment in the pipeline, setting aside all that we thought we knew about the U.S. future of manufacturing.

Who is placing that bet? Why now? And is this the beginning of something greater—or a flash-in-the-pan show before the fall? Let’s take a look.

The Death of the Steel Industry

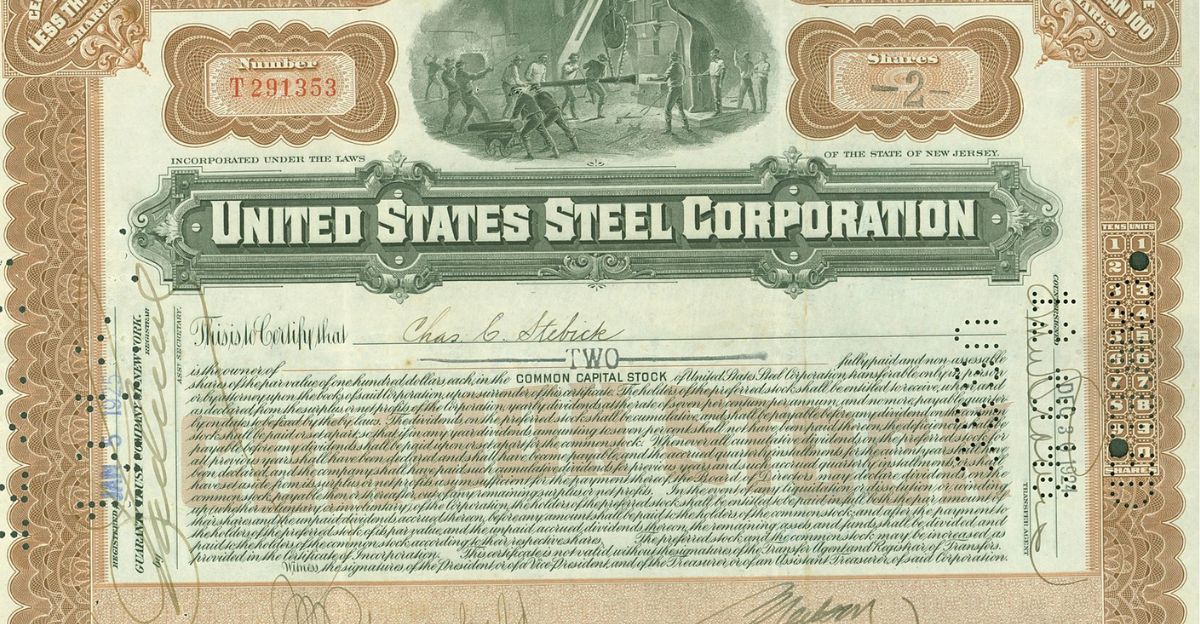

American steel once was the pride of the industrial world. But in recent decades, it became the poster child for obsolescence. International competition, lower-cost imports, and antiquated technology left U.S. Steel struggling.

Production became more expensive. Demand contracted. And innovation was an afterthought. Critics saw the writing on the wall.

The company was too behind the times to adapt and too costly to compete. The word was out: U.S. Steel was fading into obscurity, a long, cold decline.

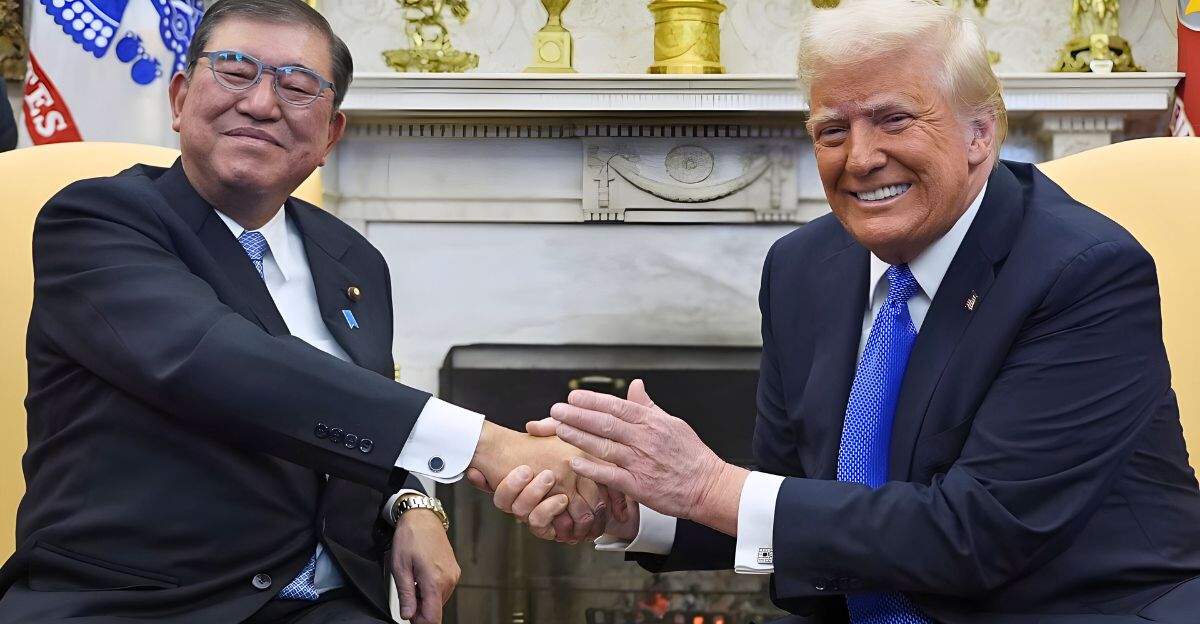

Enter Nippon Steel

And then, a twist. Japan’s Nippon Steel, one of the world’s giant steel producers, entered the limelight. Suddenly, seemingly out of nowhere, they made an offer that no one expected: a multi-billion dollar investment in U.S. Steel.

It wasn’t philanthropy. It was strategy. Nippon envisioned something others saw as collapse. And in an industry that cried out for solutions and foreign allies, the concept of collaboration—East meets West—sparked both interest and fascination.

The $14 Billion Promise

Nippon Steel’s investment wasn’t just daring—it was massive. They’re making a $14 billion bid for U.S. Steel, with $4 billion going into constructing a whole new state-of-the-art mill.

Another $11 billion will go toward modernizing and expanding current infrastructure until 2028. All of this is part of the $14 billion total Nippon is committing to.

That’s on top of creating a new greenfield location—a move insiders say could cost as much as $4 billion by itself. It’s one of the biggest steel investments in American history in decades. Why then and why so much?

Political Obstacles and National Security Issues

The jubilations were short-lived since the deal ran into a wall in Washington. Both the Trump and Biden administrations have opposed it strongly, arguing that foreign ownership of an American steelmaker undermines national security.

The Committee on Foreign Investment in the U.S. (CFIUS) re-opened the case after previously concluding their review.

The issue? That American steel, critical to defense and infrastructure, cannot be in foreign government hands, no matter how congenial. The review deadline: May 21. At stake? Something monumental.

Labor Unions Voice Opposition

The United Steelworkers union, which was the loudest voice on the ground advocating for workers, was certainly not cheering.

The union denounced the plan, which could cost American jobs, undermine American labor laws, and betray the steelworkers who built the industry.

Despite Nippon’s insistence that they’d save jobs and spur growth, the union wasn’t convinced. Their message to lawmakers? Don’t betray steelworkers for a short-term boom.

Economic Consequences and Market Responses

The response of the market was unclear. U.S. Steel shares first wobbled up, fueled by the magnitude of the investment.

But there were doubts in the air. Would the transaction succeed? Would it even happen? Investors and analysts debated. Some argued that the $14 billion signaled value long misjudged.

Others cautioned that it wasn’t sufficient, too little in a China-dominated world driven by electric arc furnaces. But it was clearly no longer business as usual.

Technological Innovation and Sustainability

Transformation was at the core of Nippon’s appeal. They held out the hope of bringing high-tech into U.S. Steel’s old mills. Including automation, AI-driven quality control, and cleaner, greener production to reduce emissions.

The new mill would be designed for sustainability, as global demand grows internationally for low-carbon steel. On paper, this would allow the U.S. to compete, not only in volume, but in quality and climate-friendly production.

Global Strategic Positioning

This is not a matter of resurrecting a legacy brand. For Nippon, this is chess, not checkers. Securing a beachhead in the U.S. market allows them to avoid high tariffs, lower shipping costs, and expand their reach across North America.

With steel demand holding strong in sectors like construction, defense, and autos, having a U.S. producer might provide Nippon with a strong global advantage over the likes of China’s Baowu Steel.

Economic Growth and Job Creation Potential

Deal advocates point to the math: billions of new developments translate into jobs. Thousands of them, maybe.

Engineers, factory workers, logistics, management—along with secondary economic growth in local economies.

The $4 billion mill itself could infuse new life into a community that has suffered its share of industrial decline. To towns hit hard by steel’s decline, this could be larger than a commercial deal—it could be a significant comeback.

Navigating Regulatory Challenges

But a financial handshake means nothing without regulatory approval. The deal would have to pass another CFIUS national security grilling.

And even then, it would be subject to potential presidential review. All while the clock is ticking. If the deal falls apart, there’s a $565 million breakup fee. It’s a risk, and everybody knows it.

The outcome could redefine not just this deal, but the manner in which foreign firms make strategic U.S. industry investments.

Broader Implications for U.S. Manufacturing

This isn’t just about steel. It’s about the future of America. Do we let foreign investment replace an inconsistent domestic investment? Can foreign investment revive dying industries without jeopardizing national interests?

And how do you balance economic growth and national security in a very interdependent world? The Nippon–U.S. Steel soap opera is compelling a long overdue national conversation.

Verdict and Future Outlook

As May 21 approaches, the world waits for Washington. A green light will usher in an age of renewed American industry in cooperation. A red light will legitimize protectionism and put shivers into future foreign investment.

Whichever path is taken, the choice will reverberate through boardrooms, union halls, and politicians’ offices for decades to come. What’s at stake is not one company—it’s a vision of what American industry can (or ought to) be.

Looking Back at the Surprising Turn

During a period when collapse looked inevitable, $14 billion knocked on the door. What appeared to be the end of an era can now become its rebirth—albeit not without struggle, politics, and valid questions about who should guide American steel into the future.

Whether Nippon Steel’s action will be hailed as courageous salvation or pipe dream ambition remains to be seen. But one thing is certain: the end of U.S. Steel may have been greatly exaggerated.

Discover more trending stories and Follow us to keep inspiration flowing to your feed!

Craving more home and lifestyle inspiration? Hit Follow to keep the creativity flowing, and let us know your thoughts in the comments below!