There’s something brewing in the world of U.S. coffee—and it isn’t espresso. Starbucks, the longtime coffee king, is beginning to feel the pressure.

Only this time, it isn’t from your typical culprits like Dunkin’ or Dutch Bros. Nope, this time it’s coming from across the ocean. A new, aggressive player with a huge following and a quickly expanding empire has American coffee lovers in its crosshairs.

As Starbucks plunges into its fifth straight sales downturn, the timing couldn’t be more noticeable. What happens when East meets West in the fight for your morning cuppa? Stay tuned.

A New Player in the Coffee Ring

If you’re reading this with a caramel macchiato in hand, grab hold of your cup—there’s a new name percolating in the coffee world. For years, Starbucks has been the king of caffeination.

But something’s in the air, and it doesn’t have the scent of espresso. A foreign rival is making a quiet inroad on U.S. turf. The question is: Can a newcomer from halfway across the world really shake the green giant?

Is Starbucks Losing Its Grip on the American Palate?

Starbucks has had a virtual monopoly on upscale coffee culture in America for decades. With its comfortable seating, reliable menu, and constantly evolving seasonal beverages, it’s less a café and more a lifestyle.

But even lifestyle brands aren’t immune to market fatigue. The last several years have witnessed sluggish growth, declining traffic, and consumers seeking something… different. Which raises the question: is Starbucks losing its cool?

Not Just a New Trend — A New Brand

Coffee trends evolve quickly. Cold foam one day, oat milk the next. But what’s new now isn’t a drink—it’s a brand.

And it’s not one you’ll find in Portland or Pittsburgh—yet. This competitor doesn’t come from a local roastery or hipster haven.

It’s crossing an ocean, bringing a tested formula from one of the largest and most competitive coffee markets in the world. And it’s already proven it can out-Starbucks… Starbucks.

Introducing: China’s Coffee Sensation

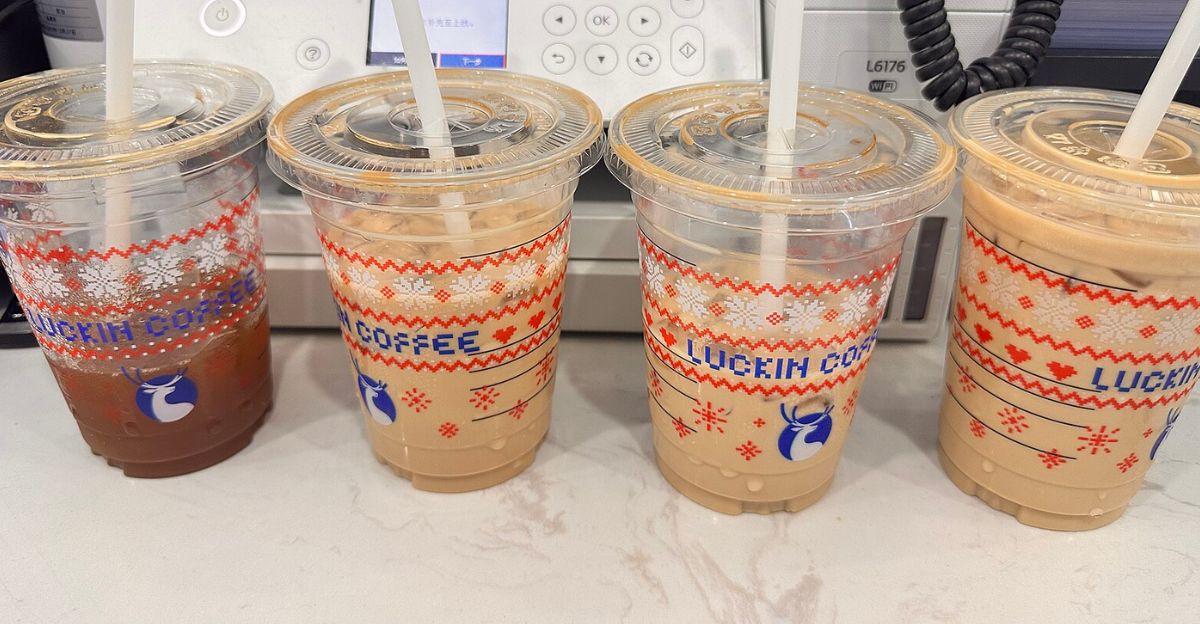

Meet Luckin Coffee. Established in 2017 in Beijing, it was a Chinese household name in no time, expanding faster than anyone anticipated. At one point, it was opening a new store every 4.5 hours.

No typo. Designed for speed and convenience, it was flourishing on a mobile-first model and rock-bottom prices, particularly popular with younger, tech-savvy consumers. Starbucks might have introduced café culture—but Luckin perfected the efficiency.

Tech, Speed, and Fun Flavors: Luckin’s Winning Method

Having surpassed Starbucks in China in terms of stores, Luckin did not get complacent. It innovated with quirky drinks (coconut lattes, cheese foam coffee) and developed an aggressive digital ecosystem that kept consumers engaged.

As Starbucks emphasized experience, Luckin emphasized access. You could place your drink order in less than 15 seconds on your phone and collect it minutes later. Quick. Painless. Affordable.

From Scandal to Comeback: Luckin’s Rough Ride

But Luckin’s tale has not been entirely smooth sailing. In 2020, it was hit by a huge accounting scandal that rattled investor confidence. Sales were falsified.

Executives were sacked. Share prices tanked. Many had written the company off. But it bounced back with surprising haste. New management took over.

Operations were overhauled. And most importantly—customers continued to return. By 2023, Luckin had more stores than Starbucks in China. That’s one hell of a comeback.

Luckin Silently Arrives in Manhattan — Starbucks’ Territory

Now Luckin has the U.S. in its sights—the biggest competitor’s backyard. Manhattan storefronts have appeared with little fanfare.

Properties at 755 Broadway and 800 6th Ave are covered in blue-and-white signage with “Opening Soon” notices. No big PR push, no showy ads (yet).

Just quiet confidence. If their quiet launch plan is anything like what they did at home, Starbucks may be in for a surprise.

Starbucks’ Dip Meets Luckin’s High — Divine Timing?

While Luckin’s U.S. expansion isn’t yet official, the timing couldn’t be more fortunate—or unfortunate, depending on whom you’re asking.

Starbucks just reported its fifth consecutive quarter of falling sales. Traffic in stores is down 4%, and same-store transactions dropped another 2%.

For a company accustomed to rising momentum, these declines are troubling. Particularly when younger consumers are more open than ever to trying something different. Such as Chinese iced coffee?

Can Luckin Win the Heart of the Picky American Market?

Yet the American market is famously picky. Numerous foreign food chains have attempted and failed to win over U.S. hearts—and wallets.

Just because Luckin rules China doesn’t mean the same will happen on U.S. soil. Cultural tastes vary. Brand loyalty comes into play.

And let’s not overlook the fact that Starbucks still boasts more than 15,000 U.S. stores and profound emotional equity. The green mermaid isn’t going down without a fight.

Mobile-Friendly, Good Prices, and Fresh — Luckin’s Edge

That being said, there are real benefits to Luckin. It understands how to scale. Its mobile-first model might appeal to Gen Z and Millennials who already shop everything by app. And the price? Often lower than Starbucks—without a dip in quality.

That price-speed-novelty equation might attract budget-conscious, taste-experimental Americans—particularly those who are fed up with Starbucks’ ever-predictable menu and inflated prices.

A Coffee World Beyond Starbucks

Beyond Starbucks, the whole U.S. coffee landscape is shifting. Chains such as Dutch Bros, 7 Brew, and Scooter’s Coffee have experienced increased traffic and loyal followings.

Dunkin’ has continued to innovate. None have yet dethroned Starbucks, but they’ve shown that customers are willing to consider options.

Luckin doesn’t come in as an underdog—but as a proven disruptor. And in a space already hungry for disruption, it might find fertile soil.

How Will Luckin’s U.S. Stores Look?

So what will the U.S. version of Luckin be like? If it’s a clone of its Chinese prototype, anticipate minimalist stores focused on grab-and-go orders, minimal seating, and a robust digital infrastructure.

Think less of a ‘third place’ hangout, more caffeine pit stop. Anticipate flavor innovation, too—distinctive beverages designed for worldwide tastes, not just pumpkin spice everything. If Starbucks is the iPhone of coffee, Luckin wishes to be the streamlined, budget-friendly Android.

A Coffee Battle That Could Mean Innovation

Can both brands coexist? Absolutely. America loves choice—and coffee. But this brewing combat might make both companies evolve more quickly.

Starbucks may have to reinvent pricing, technology, and even store layout. Luckin, on the other hand, will have to establish trust and figure out an entirely new culture.

It definitely won’t be easy. But this collision of caffeinated giants guarantees one thing: consumers will benefit.

The Brewing Showdown for the US’ Coffee Crown

As New Yorkers take their first sip of Luckin, the rest of America will be waiting—and likely ordering a sip after spotting it on Instagram.

Will this Chinese upstart capture U.S. hearts and mugs? Or will Starbucks solidify its rule with a rich blend of innovation and loyalty? One thing’s for sure: this coffee war is just getting started. And it won’t be lukewarm.

Discover more trending stories and Follow us to keep inspiration flowing to your feed!

Craving more home and lifestyle inspiration? Hit Follow to keep the creativity flowing, and let us know your thoughts in the comments below!