For over a decade, self-checkout was the retail future, speed, convenience, and cost savings. However, in 2025, nine of the largest retailers in the world are kicking these systems to the curb in an unbelievable reversal.

The purpose of these systems was to make shopping easier for customers, but it has ultimately led to more theft, longer lines, and messier stores. This goes against automation’s dominance and communicates something greater regarding human behavior and trust in retail.

As retailers like Dollar General and Walmart scale back self-checkout, the industry seeks a new approach balancing efficiency with personalized service. What’s next for shopping?

The Psychology of “Just This Once” Theft

It’s not just career criminals. Everyday shoppers fall into the trap. With no one watching, people blur the lines, blaming tech errors or telling themselves it doesn’t hurt anyone. The lack of human interaction lowers the bar for crossing it. Even honest people are more likely to slip into “gray area” theft, fueled by rationalization and moral detachment.

How Bad Is It?

The numbers are brutal. Theft at self-checkout can be up to 65% higher than at regular lanes, with shrinkage hitting 3.5% of sales compared to just 0.21% with human cashiers. One Capital One study found 15% of users admit to stealing at kiosks, and 44% say they’d do it again. That adds up to over $10 billion in losses for food retailers each year. With self-checkout transactions 16 times more likely to involve theft, stores are realizing the convenience comes at a staggering cost.

From Time-Saver to Time-Waster

Self-checkout was supposed to streamline the shopping trip. Instead, it’s become a hassle. Glitches, long lines, and the DIY burden of scanning and bagging have worn thin. For big baskets, traditional checkout lanes actually perform better, and customers notice. Studies show those using staffed lanes feel more valued and are more likely to come back.

Losing the Little Moments

There’s more at stake than lost time or stolen goods. Self-checkout eliminates casual chats with cashiers, those brief, human connections that matter more than we think. In a time when loneliness is rising, these micro-interactions help us feel part of something. Experts warn that technology, when overused, can slowly strip away our everyday sense of community.

So, which retailers have already shut down self-checkout?

# 1: Dollar General

Dollar General has taken one of the boldest steps away from self-checkout in recent memory. By May 2024, the chain had yanked self-checkout from 12,000 of its 20,000+ stores, dropping its earlier push toward 100% self-service locations. CEO Todd Vasos blamed “shrink,” or inventory loss, calling self-checkout the company’s biggest obstacle. Remaining kiosks now cap purchases at five items, and 9,000 stores have shifted to “assisted checkout.”

# 2: Five Below

Five Below quietly pulled self-checkout from its highest-risk stores, revealing a tough truth, automation doesn’t work everywhere. CEO Joel Anderson said returning to staffed lanes did more to curb theft than adding extra security. The data showed that some neighborhoods saw massive spikes in shoplifting when kiosks went unmanned. So the company tailored its checkout systems based on local risk. It’s a reminder that retail tech needs to reflect real-world conditions, not just Silicon Valley’s idea of efficiency.

# 3: Target

In March 2024, Target put a cap on self-checkout: 10 items or fewer across nearly 2,000 U.S. stores. Framed as a customer experience improvement, the timing closely mirrors broader industry worries over theft. Target says the change was based on shopper feedback, not shrink concerns, but the connection is hard to ignore. The good news? Wait times are down at both staffed and self-checkout lanes.

# 4: Walmart

Walmart is testing a new tactic: limiting self-checkout access to Walmart+ members and Spark drivers in select stores. It’s a bold shift that makes automation feel more like a premium perk than a standard option. The move helps reduce theft by tying kiosk use to verified customer accounts. Alongside this, Walmart is adding invisible barcodes and AI-driven monitoring to keep checkout fast but secure.

# 5: Amazon

Amazon’s grand vision for cashierless shopping hit a wall in April 2024 when it dropped “Just Walk Out” from its Fresh grocery stores. The tech, which was supposed to track purchases automatically, relied heavily on human reviewers, over 1,000 people in India checking transactions manually. With 70% of purchases needing intervention, the system fell far short of its promise. Customers also missed real-time receipts and transparency.

# 6: Costco

Costco isn’t scrapping self-checkout, but it’s adjusting how it works. The company is expanding its “Scan & Pay” trial, modeled after Sam’s Club. But bulk buying poses unique risks. Large orders and high-value items increase the chance of loss at kiosks. Some stores are quietly setting item limits, ranging from 5 to 20 per trip, even if these caps aren’t officially standardized.

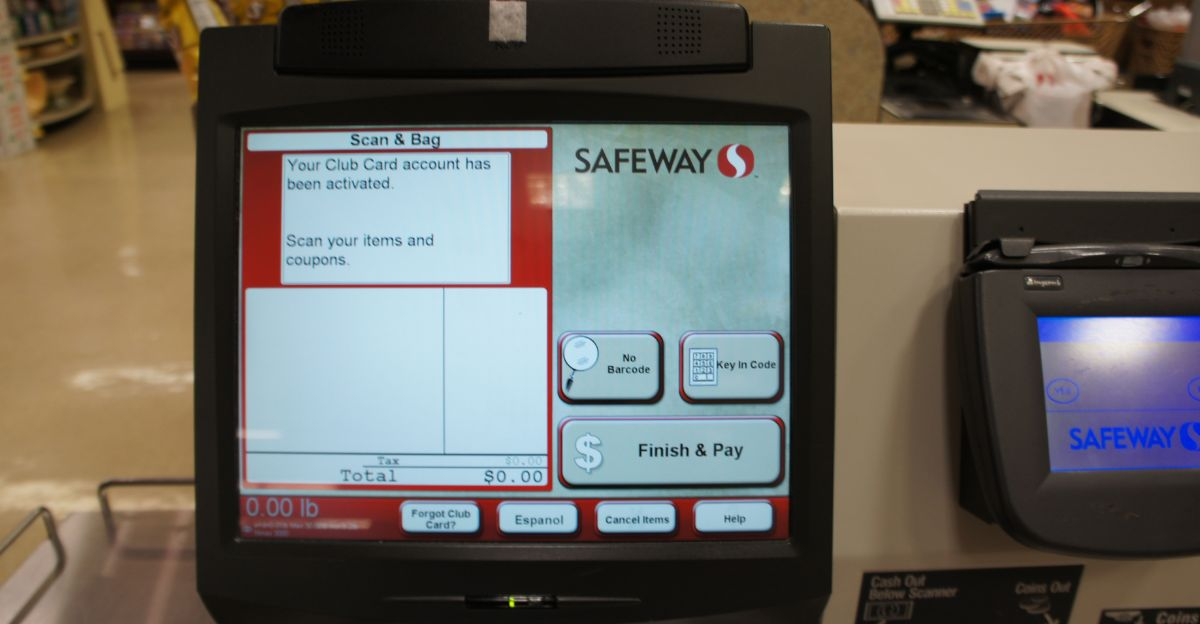

# 7: Safeway

Safeway isn’t ditching self-checkout everywhere, but it is pulling back in select high-risk areas. As of May 2024, the chain removed kiosks from a handful of Bay Area stores, including locations in San Francisco, Oakland, and Emeryville. The move responds to local theft issues, not a sweeping policy shift.

# 8: Wegmans

Wegmans pulled its popular “scan and go” mobile app back in 2022, ahead of the larger industry trend. Why? Too much theft. The upscale grocer found that even well-off customers couldn’t be trusted to scan honestly. Despite how much shoppers loved the speed and simplicity, the company said losses made the program unsustainable. Customers received $20 digital coupons as a goodwill gesture, and Wegmans hinted it may try again with better safeguards.

# 9: Kroger

In February 2024, Kroger reversed course on one of its most ambitious automation tests—a Dallas store that ran entirely on self-checkout. After three years, the grocer brought back staffed lanes due to customer dissatisfaction. According to Kroger spokesperson John Votava, it came down to listening. Shoppers wanted human interaction and a smoother experience. Even with heavy investment in the no-cashier model, Kroger admitted it had to prioritize customer relationships over innovation. The lesson? Just because tech is possible doesn’t mean it’s the right fit.

The Human Connection Comeback

Retailers aren’t just bringing back cashiers, they’re redefining their role. These workers are now multitaskers: problem-solvers, security monitors, and frontline customer service. While 73% of shoppers may prefer self-checkout in theory, in practice, real staff reduce shrink, improve service, and rebuild trust.

Why People Still Matter

Retailers are waking up to something essential: humans are good for business. Cashiers don’t just scan items, they stop theft, solve problems, and make shoppers feel seen. Stores like Target and Dollar General are hiring again, not just for security, but to rebuild relationships. In a digital-first world, human presence has become a competitive edge.

The Real Price of Going All-In on Machines

Self-checkout may save on payroll, but it comes with hidden costs. Theft, tech breakdowns, customer frustration, and weakened brand loyalty are adding up. What looked like a win on paper is quietly draining profits. Retailers are learning the hard way that automation, when overdone, can do more harm than good.

The Generational Divide

Younger shoppers—Millennials and Gen Z—often prefer the speed of self-checkout. Older customers? Not so much. Many find the process confusing or impersonal and prefer human help. Some research even suggests younger users are more likely to admit to theft. The takeaway: retail strategies that work for one group might alienate another.

Reinventing the Checkout Line

The answer isn’t ditching tech altogether; it’s blending it better. Hybrid models are gaining ground: quick self-checkout for small hauls, staffed lanes for big carts, and new systems that pair automation with real people. Retail’s future lies in balance, with technology serving people, not replacing them.

The Takeaway—It’s About Trust

Self-checkout was never just about machines; it was about trust. And right now, that trust is broken. Shoppers want more than speed; they want connection, security, and to feel like more than just another transaction. The stores that thrive will be the ones that get this balance right and put people back at the center.