The 2025 tariffs on the U.S. have created enough consumer cost emergency to rush consumer households to an average of a $3,800 per annum reduction in the purchasing power of other goods and services due to inflation on regular consumer goods.

Firms from electronics to avocados pass tariff costs on to buyers, breaking decades of deflationary globalization. It’s not only about more expensive goods; it’s a structural change transforming how we budget, save, and economically maneuver.

As tariffs drive up the price of core goods by 0.3%, the hit falls heaviest on low-income families, retirees, and communities dependent on imported essentials. The age of cheap plenty is at risk.

Understanding the Real Impact of Tariffs on Your Wallet

A Federal Reserve study paints a picture of near-complete tariff cost pass-through, with 90% of import taxes on Chinese goods feeding through to U.S. prices. The tariffs aren’t getting absorbed like in trade wars in the past; 76% of them are being passed directly onto consumers and not eaten by manufacturers.

That full pass-through is born of squeezed corporate margins and concentrated supply chains. Because domestic producers maintain relatively fixed dollar markups, even products with partial import content, say, appliances (17% price jump), spike well above the inflation line. The result? An overall 2.3 percent price surge, the highest since 1909.

Where the Economic Pain Is Hitting the Hardest

The manufacturing, energy, and agriculture sectors face an existential threat. U.S. chemical exports to China (18% of all sales) and $18.2B in agricultural exports are at risk, which causes domestic price hikes to compensate for lost business.

Clothing prices increase by 17%, and electronics and machinery, reliant on Chinese intermediaries, face 10-15% raises. Even “Made in USA” products are not immune: tariffs on Canadian steel escalate construction costs, and Mexican avocado prices increase by 25%. These sector-wide shocks ripple through supply chains, hitting consumers at every purchase stage.

Why Staple Food Prices Keep Skyrocketing in Grocery Stores

Tariffs are reshaping what ends up on the dinner table. Essential prices are climbing fast, Mexican avocados up 25%, Canadian dairy 20%, and Chinese garlic 30%. Processed foods take the brunt, with tomato sauce now hit by multiple tariffs on Mexican tomatoes, Chinese packaging, and Canadian aluminum cans.

The average family could see their annual grocery bill climb by $1,200. Food for low-income households now eats up 35% of their income, compared to just 8% for wealthier families. Proteins like beef and seafood are also getting pricier, rising 15–18%, driven by tariffed feed and imports, pushing many to rethink their meals.

The Growing Gap Between the Rich and The Less Privileged in a Tariff Economy

Yale research shows tariffs are a hidden tax that hits lower-income families the hardest. Poorer households lose around $1,700 annually, while middle-class families lose about $5,200. Retirees on fixed incomes and rural residents get squeezed the most, facing up to 50% higher costs on essentials like Indian-imported prescription drugs and farm equipment.

Meanwhile, wealthier households, with more savings and better access to alternatives, feel just 40% of these cost hikes. This uneven burden deepens the gap between rich and poor, especially as prices rise faster than wages in service jobs, where nearly 70% of low-wage workers make their living.

Why Border States Feel the Pain First

Texas manufacturers pass on 76% of tariff costs to their customers, pushing up prices for electronics made in Austin’s booming tech sector and construction materials tied to Houston’s massive petrochemical industry.

In California, ports absorb a 22% increase in cargo costs, which raises prices on roughly 40% of all U.S. imports. Midwestern farmers take a double hit: China’s tariffs slash soybean exports, while Canadian duties on fertilizer drive up what they pay to grow crops.

In the Southeast, states dependent on Mexican produce now pay 30% more for fruits and vegetables, deepening food insecurity in struggling areas.

The Business Math Behind Passing Costs to Consumers

Retailers, operating on slim 8% profit margins, cannot absorb import cost hikes of 10–25% without facing bankruptcy. The National Retail Federation warns that proposed tariffs could slash consumer purchasing power by $78 billion annually.

That means prices would jump, or companies would have to downgrade products. Take a $300 bike, for example; tariffs push its cost to $345.Sure. Here’s a version using simple English, active voice, and a natural, human tone:

A company may start using cheaper parts to keep prices steady, which can lead to safety problems and product recalls. It’s a lose-lose choice: either raise prices and risk losing customers, or keep prices low and struggle to survive rising costs.

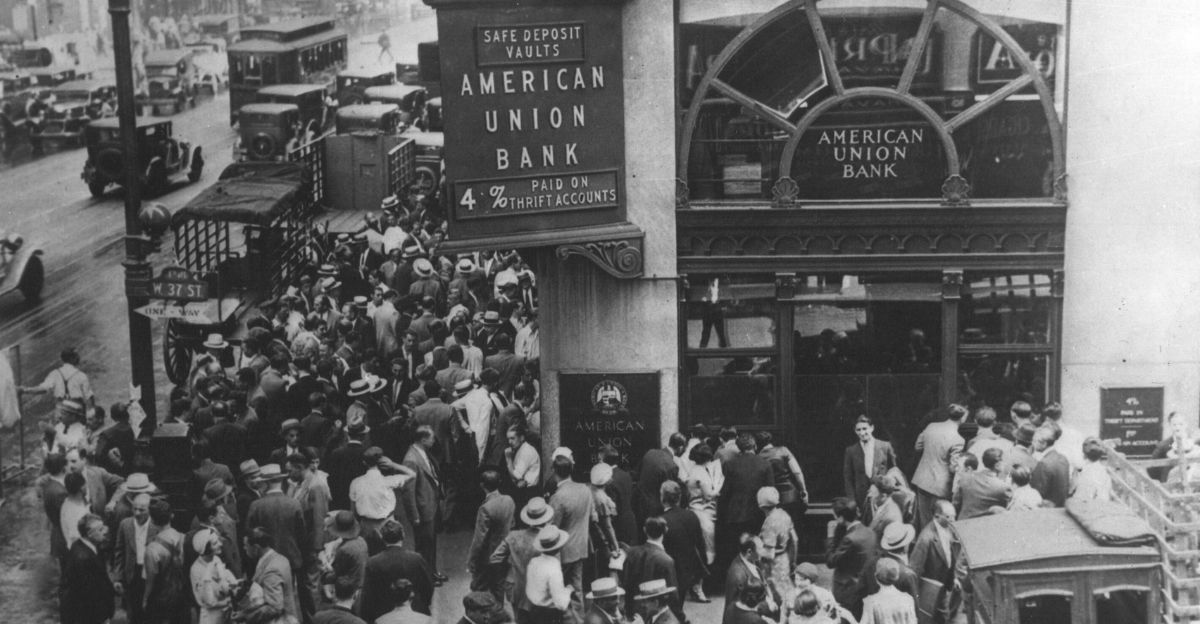

What We Can Learn from 1930s Trade Mistakes Today

The current average tariff rate stands at 22.5%, matching the levels of the 1930s Smoot-Hawley Act, which helped trigger the Great Depression. Retaliatory tariffs like China’s 25% on U.S. autos and the EU’s 20% on bourbon add to the strain, echoing past economic pain.

But today’s globalized supply chains make the hit even harder. In the 1970s, tariffs affected just 8% of trade; now, they touch 45%. The Federal Reserve warns that if tariffs stay, the U.S. could see a 0.6% drop in GDP, or $180 billion annually, pushing the economy closer to a dangerous repeat of 1970s-style stagflation.

The Hidden Cost of Tariffs on Technology and Progress

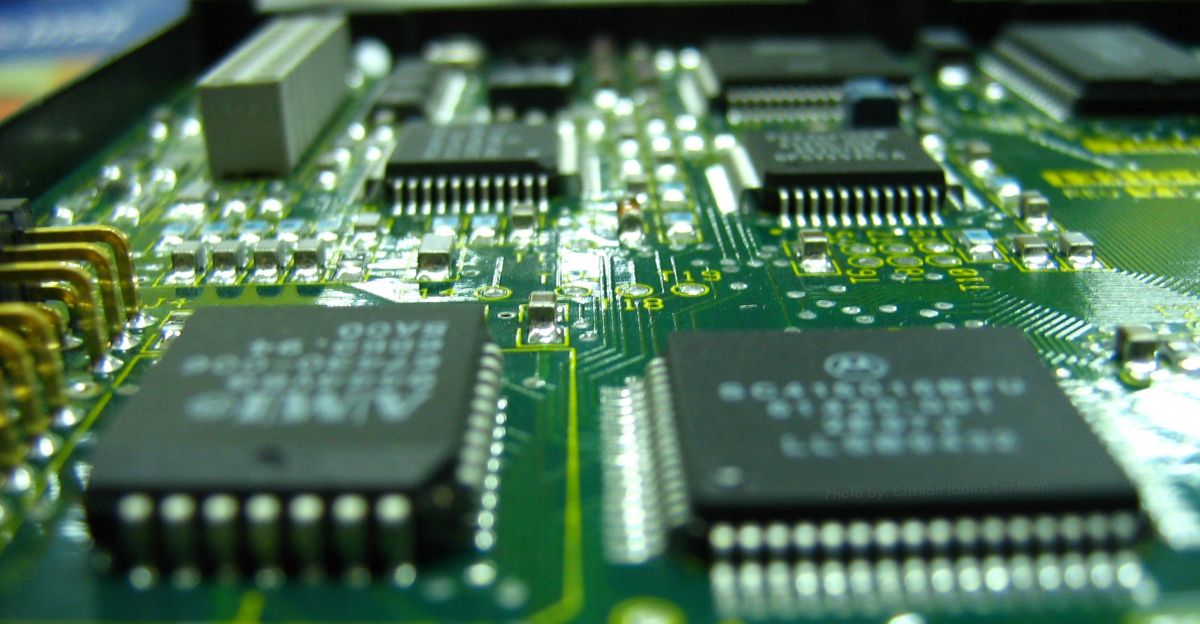

Even though tariffs aim to boost domestic production, they slow down tech innovation. A 25% tariff on semiconductors, which make up 60% of imports from China and Taiwan, adds around 12% to the cost of an iPhone.

Green energy progress also takes a hit, with Chinese solar panels facing tariffs of over 50%, making clean energy more expensive. Ironically, U.S. factories that rely on robots from Japan or Germany also suffer, becoming less competitive globally.

Experts predict a 10% drop in tech industry growth by 2026, rolling back key productivity gains that help ease rising consumer prices.

Facing the Cost Challenge with Better and Balanced Strategies

Tariffs raise pricing and stress a world economy already on the edge. When governments pursue these protectionist policies to support select industries, they hurt the ordinary person the most. Families living paycheck-to-paycheck pay a higher cost for necessities, complicating everyday living and widening the gap between the rich and poor.

It takes prudent action to prevent a more serious crisis, raising tariff rate quotas on essential commodities like food and medicine, providing direct relief to low-income families, and pursuing smart global negotiations to roll back retaliatory tariffs. Without these actions from leaders, the U.S. risks developing a full-blown cost-of-living crisis, threatening the middle class and exacerbating inequality.

Discover more trending stories and Follow us to keep inspiration flowing to your feed!

Craving more home and lifestyle inspiration? Hit Follow to keep the creativity flowing, and let us know your thoughts in the comments below!