For the past 20 years, the U.S. federal debt has seen sharp spikes caused by monumental events. The 2008 financial crisis and the COVID-19 pandemic were two major driving forces behind the surge in the country’s debt.

Earlier this month, President Donald Trump signed off on a budget plan that is projected to add trillions more to the debt. In the aftermath of this budget plan’s enactment, one economic expert has once again warned the American public about the implications of the current debt situation. According to this expert, the country could experience an economic shock if the situation isn’t mitigated.

A History Lesson On U.S. Debt Levels

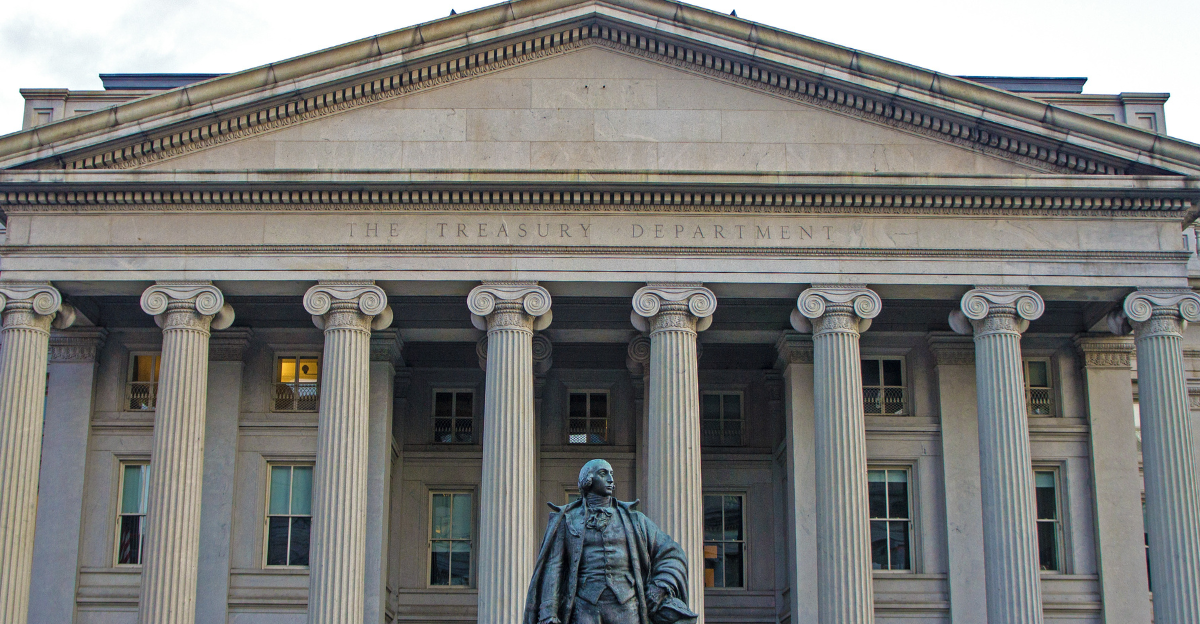

To understand how dire the U.S. debt situation has become, we need to look at how the debt has eaten up the economy through the years. Prior to the 2020s, the country’s highest debt level was seen in 1945 when the debt accounted for 112% of the GDP. Translation: The debt was way bigger than the entirety of the U.S. economy after World War II.

How Trump’s Megabill Affects The U.S. Debt

At the start of this year, the Congressional Budget Office had projected that the U.S. could overtake that record debt level by 2032. What’s even more troubling is that the record could be broken sooner, now that President Trump has signed the “One Big Beautiful Bill,” which is widely projected to add at least $3 trillion to the national debt within a 10-year period.

Even before Trump enacted this law, the debt reached a new record high of $36.2 trillion this year. This means that each American bears a debt of roughly $106,000.

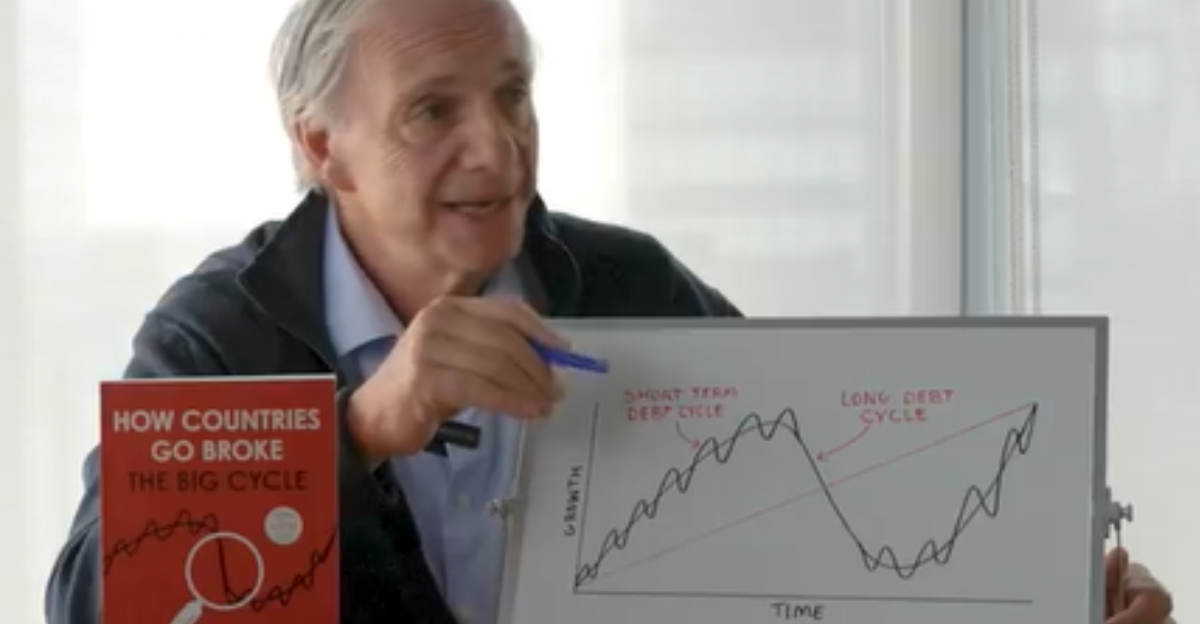

Enter Ray Dalio, The Economic Visionary

The grim projections have led to a strong warning from billionaire and New York Times bestselling author Ray Dalio. In a Tweet posted on July 23, Dalio sounded the alarm on the implications of the ever-ballooning deficit.

There are plenty of good reasons to listen to Dalio, whose investment management firm Bridgewater Associates has worked with clients like McDonald’s and the World Bank. Back in 2007, Dalio (via Bridgewater) predicted that the U.S. financial system would start “cracking” as a result of rising interest rates. Dalio’s prediction came to pass as the country went through a financial crisis just a year later.

Dalio’s Prediction: “An Economic Heart Attack”

Now, Dalio is predicting that the U.S. will experience “an economic heart attack” if proper steps to address the debt situation are not taken. To be specific, Dalio has projected that this economic shock could happen within the next three years. Notably, this is aligned with the projections of the debt level reaching a new record high as a result of the tax and spending megabill enacted by Trump.

Dalio’s July 23 post was not the first time that he issued a warning on the debt situation. A month earlier, he talked about “spiraling US debt levels” that could potentially lead to another financial crisis. In all likelihood, Dalio was hoping that policymakers would have a sense of urgency to deal with this impending scenario. However, Dalio bemoaned on July 23 that “the basic picture has not changed.”

How Can The Economic Shock Be Averted?

Dalio did provide a big-picture solution to prevent the “economic heart attack” from happening. According to the Bridgewater founder, the government needs to work towards cutting the deficit to 3% of the GDP.

As daunting as the debt situation is, Dalio offered a tone of optimism in his Tweet. “The good news is that these cuts are possible. If we change spending and income (tax returns) by 4% while the economy is still good, the interest rate will go down as a result and we’ll be in a much better situation,” he wrote.

What Else Has Dalio Said About This Matter?

A month before Dalio posted this Tweet, he rang the same alarm bells during a promotional event for his new book How Countries Go Broke: The Big Cycle. At this event held in New York, Dalio got deeper into the heart attack metaphor. “It’s like a plaque building up in the arteries,” Dalio said during this event. “You can see interest rates and debt service payments starting to squeeze out other consumption.”

Dalio, who was ranked #124 on Forbes’ list of richest people in the world last December, offered a number of strategies that the U.S. government can employ to curb the rising debt. These strategies include increasing tax revenue, bringing interest rates down, and implementing cuts on spending.

What The 90s Can Teach Us About Saving The Economy

Interestingly, Dalio looked to the past as an example of how the U.S. economy can improve. He specifically pointed to the eight-year period from 1991 to 1998 as an exemplar of the “balance” that could be achieved in expenditures and tax revenues.

The numbers back up Dalio’s point. According to data from the U.S. Treasury, the debt level plateaued at 66% from 1995 to 1996 before declining steadily for the rest of the decade. By 2001, the debt level had gone down to 55% of the U.S. GDP. In other words, there is a blueprint for the U.S. economy getting back in relatively good shape. This blueprint, moreover, comes from the not-so-distant past.

Can Democrats And Republicans Work Together To Stop This?

However, Dalio ended his July 23 Tweet with a cold dose of reality. “My fear is that we will probably not make these needed cuts due to political reasons,” he admitted. In a separate Tweet earlier this month, Dalio criticized U.S. politicians for being too “absolutist” in terms of their respective parties’ economic policy.

Offering yet another grim projection of the future, Dalio expressed another fear: that Americans will run into “even more debt and debt service encroaching on our spending that will ultimately lead to a serious supply-demand problem.”

How The Debt Situation Impacts The General Public

Ultimately, the effects of the ballooning U.S. debt will affect generations of Americans. Higher loans, subpar wages, and surging prices of goods and services are just a few examples of the national debt’s impact on citizens. Unless steps are taken to lower the deficit, the country will continue to hurtle towards an economic meltdown that Dalio and other experts have been warning everyone about.