Wall Street just watched history happen. And what was that? Nvidia. The giant tech company is now sitting on a market cap that’s bigger than entire countries’ GDP. A whopping four trillion dollars… let that sink in.

This didn’t happen by accident. It happened because the world is drunk on AI and Nvidia is serving the strongest shots. The company just found its way back into China too. That move alone sent investors sprinting to buy more shares. The question hanging in the air now? How far can this ride go before someone yells last call.

Background

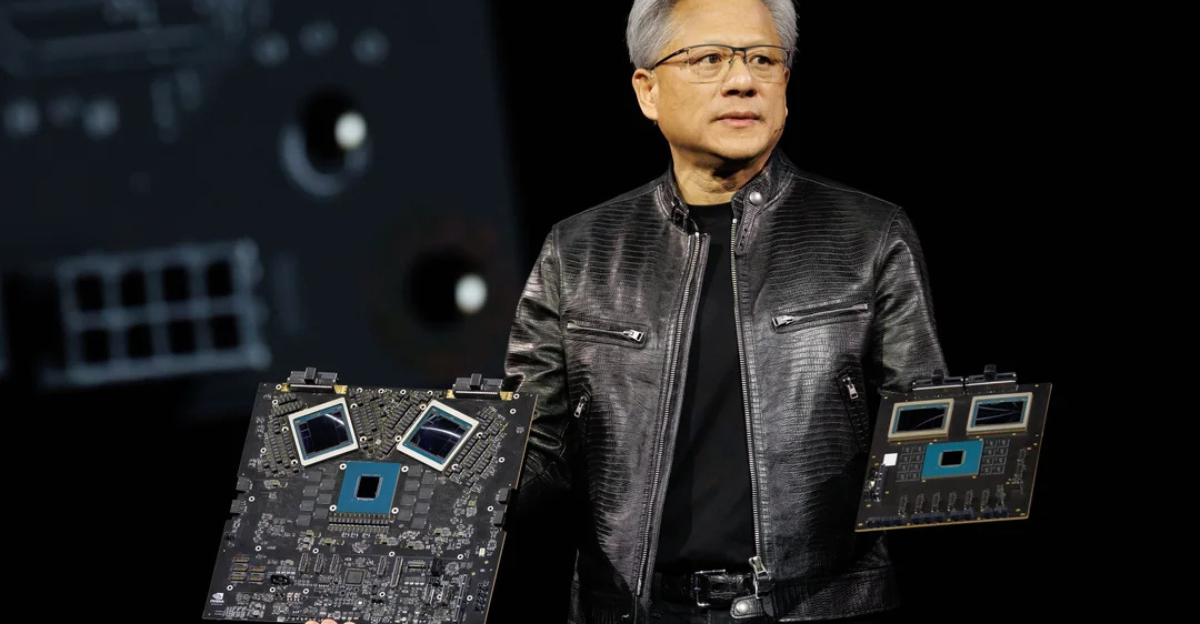

Back in 2022 the U.S. decided to pull the brakes on AI chip exports to China. The government called it national security. Nvidia called it a headache. Those restrictions hit hard because China was one of its biggest markets. Suddenly the company couldn’t send its most powerful chips across the Pacific. Consequently, revenue dipped and competitors started sniffing around for openings. Nvidia had two choices. It could either walk away or get creative. And let’s be honest, Jensen Huang doesn’t really do “walk away.” So they went back to the drawing board and started cooking up something that would play by Washington’s rules.

The H20 Chip

So here’s what they cooked up. The H20. Sounds like a bottle of water, except it’s anything but that. It’s a toned-down cousin of Nvidia’s superstar, the H100. Why toned down? Because U.S. rules said no heavy hitters in China. So Nvidia trimmed just enough power to make regulators happy while keeping Chinese buyers interested. And it worked. The H20 kept Nvidia’s name alive in China’s exploding AI scene, even when everyone thought they were locked out for good.

Political Reversal

Then came the twist. After months of back-and-forth, the U.S. government eventually granted Nvidia the necessary export licenses. While the details of the discussions remain largely confidential, the approvals allowed the H20 chip to flow back into China. This was exactly what Nvidia needed to regain a foothold in China’s booming AI market. For Nvidia, it meant billions in lost revenue beginning to recover. For Wall Street, it was champagne-popping time.

Market Reaction

What followed was phenomenal. Nvidia shares jumped more than 4 percent in a single day. That’s over 200 billion dollars added like it was loose change. The company’s value blasted past 4.1 trillion, putting it in a league where very few players even exist. Investors loved the China news, but it wasn’t just that. It was the story,Nvidia pulling off another comeback when everyone thought the walls were closing in. Now traders are asking if this is the top or if the rocket still has fuel. For now, nobody’s selling their tickets.

Analyst Outlook

Analysts wasted no time jumping on the hype train. Melius Research bumped its target price higher, betting Nvidia is just getting started. They model revenue climbing hard through fiscal 2026. And it’s not just Nvidia cashing in. Big names like Alibaba, Tencent, and Baidu are lining up for chips, fueling an entire ecosystem. To some investors Nvidia is the well. Everyone else just knows you need its gear to run serious AI. Either way, Wall Street thinks this run isn’t a sprint, it’s looking more like a marathon.

Nvidia’s Broader AI Infrastructure Leadership

Nvidia isn’t just selling chips. It’s selling the foundation of the entire AI boom. Think of it like the company building roads while everyone else is buying fancy cars. Their latest GPU lineup, Blackwell, is the new superstar every major cloud provider wants, like, yesterday. Demand is so high that delivery schedules sound like concert ticket drops. Analysts estimate the AI computing market could hit 160 billion dollars this year, and Nvidia owns the stage. They push the swell that everyone else tries to surf. And right now, everyone else is just trying to keep up.

China’s AI Landscape and Nvidia’s Role

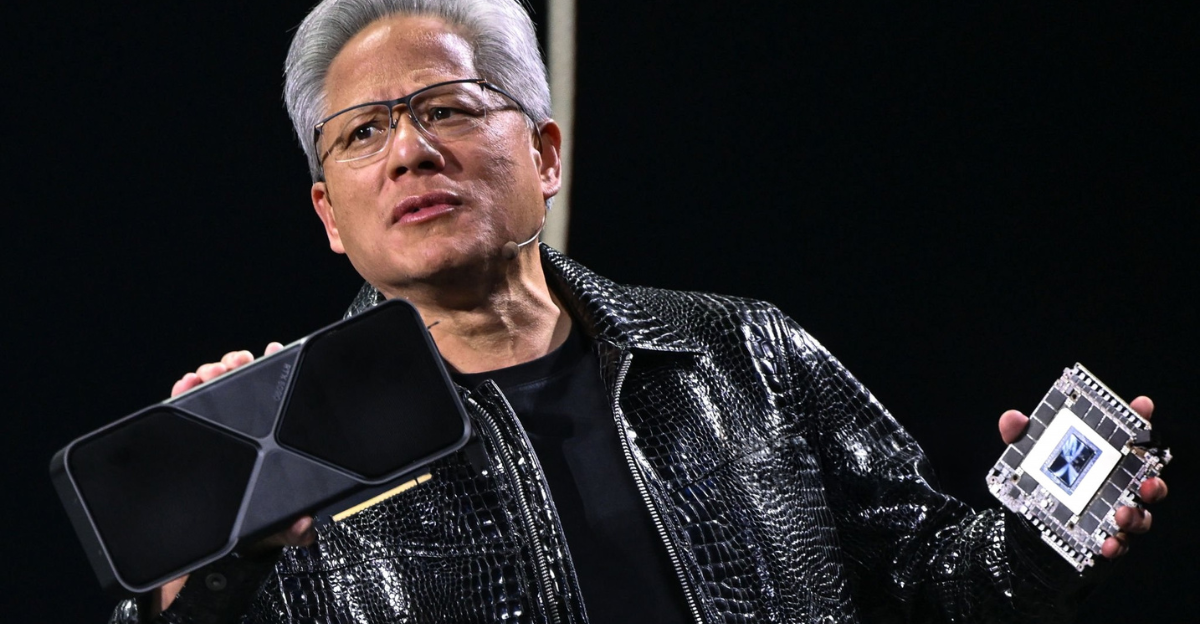

China didn’t hit pause while Nvidia was on the sidelines. Local developers kept pushing out open-source AI models, building their own versions of ChatGPT and more. But when Nvidia chips came back into play, it was like swapping in premium gas on race day. Companies like Alibaba and Tencent snapped up inventory as fast as it hit the docks. Jensen Huang even showed up in China recently, smiling for photos and talking about innovation like a rock star on tour. The message was clear, China wants to lead in AI, and Nvidia plans to be right there in the spotlight.

Geopolitical and Trade Context

This isn’t just about chips. It’s about two superpowers trying to outthink each other without blowing up the global economy. The U.S. wants to keep its tech edge. China wants access to the best tools. In between sits Nvidia, holding the hardware everyone wants. Trade talks have been tense, with rare earth materials and tariffs thrown into the mix like poker chips. The recent export green light feels less like a favor and more like a deal in a bigger game. For now, both sides get what they need,and Nvidia walks away as the real winner.

Conclusion: Nvidia at the Forefront of the Global AI Revolution

So here we are. Four trillion dollars in market value and a company that refuses to slow down. Nvidia has gone from a gaming chip maker to the backbone of the AI gold rush. They took a hit with export bans, found a workaround, and then came roaring back when the gates reopened. Now they’re supplying the picks and shovels for an industry rewriting the rules of tech and maybe even the world economy. The question isn’t if Nvidia will shape the future. It’s how much of it they’ll own when the dust finally settles.