Kraft Heinz and General Mills, two of America’s largest food producers, have pledged to remove all artificial dyes from their U.S. product lines by the end of 2027. This decision aligns with mounting regulatory pressure and a growing consumer demand for healthier, cleaner food options. Artificial dyes, widely used for decades to enhance product appearance, especially in children’s foods, are now under scrutiny for potential health risks.

The U.S. Department of Health and Human Services, led by Secretary Robert F. Kennedy Jr., has been instrumental in pushing this initiative as part of the “Make America Healthy Again” campaign. While about 85–90% of these companies’ portfolios are already free of synthetic dyes, the remaining 10–15% will undergo reformulation. This shift is estimated to carry a maximum combined revenue risk exceeding $5.6 billion due to reformulation costs and potential consumer rejection of new product versions.

Background on Artificial Food Dyes

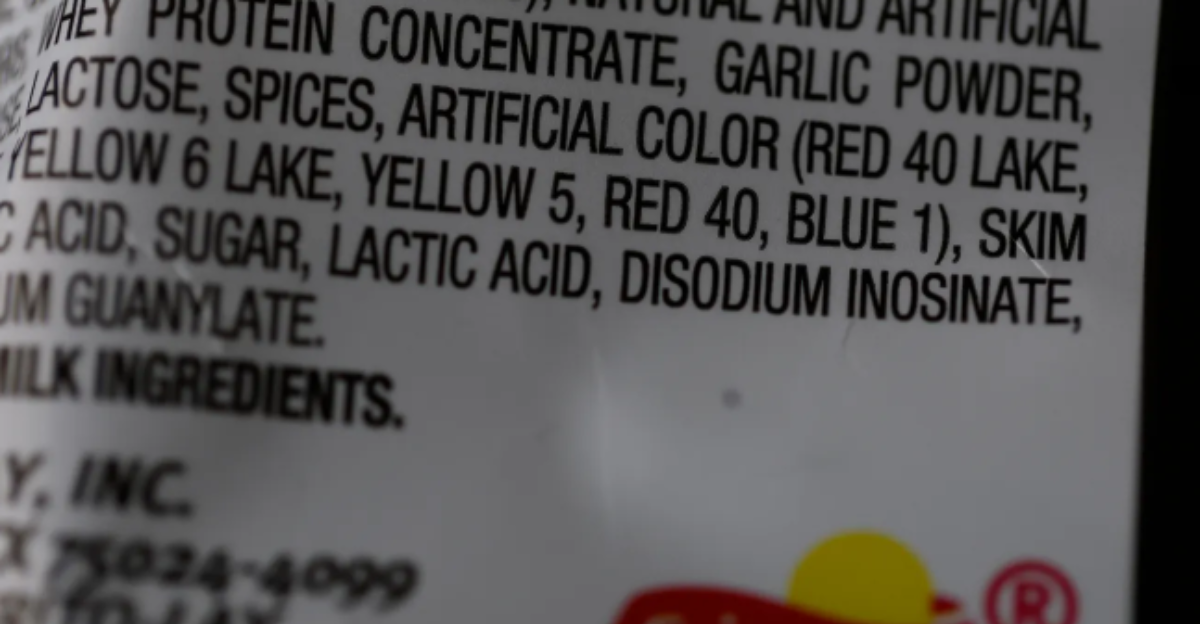

Artificial food dyes, known as FD&C colors, are synthetic, petroleum-derived additives approved by the FDA to enhance the visual appeal of many processed foods and beverages. These dyes are especially common in products targeting children, such as cereals, snacks, and drinks. Historically, they have played a key role in food marketing by making products more visually attractive and recognizable.

Despite their widespread use, these dyes have faced increasing criticism for their synthetic origins and potential health concerns. Kraft Heinz and General Mills have already eliminated artificial dyes from many products, but a notable portion of their portfolios still rely on these additives.

Health and Regulatory Concerns

Scientific studies and government agencies have raised concerns about artificial dyes’ potential adverse health effects, including neurobehavioral issues like hyperactivity in children. In April 2025, the FDA announced plans to phase out petroleum-based synthetic dyes by 2026 and to establish national standards favoring natural alternatives.

This regulatory push is part of a broader health initiative led by Health Secretary Robert F. Kennedy Jr., aiming to reduce synthetic additives in the food supply. Although the FDA maintains that approved dyes are safe for most consumers, the agency’s move signals a significant shift toward stricter oversight and voluntary industry compliance.

Corporate Commitments and Timelines

Kraft Heinz has committed to removing artificial dyes from all its U.S. products by the end of 2027, halting the launch of any new products containing them immediately. Similarly, General Mills plans to remove dyes from all cereals served in K-12 schools by summer 2026 and its entire U.S. retail portfolio by 2027.

Both companies emphasize that 85–90% of their products are already free of artificial dyes, focusing on reformulating the remaining 10–15% of their portfolios. This phased approach reflects a balance between regulatory expectations and operational feasibility.

Impact on Product Lines

Several iconic brands will be affected by the dye removal. Kraft Heinz’s products, such as Kraft Mac & Cheese, Jell-O, Kool-Aid, and Jet-Puffed marshmallows, currently use artificial dyes, while Heinz ketchup has been dye-free for years. Replacing synthetic dyes with natural alternatives poses technical challenges, particularly for beverages and desserts where color vibrancy is critical to consumer appeal.

Companies are exploring reformulation strategies, including reinventing product colors where natural substitutes do not match synthetic hues, to maintain brand identity and consumer satisfaction.

Financial Implications and Market Reaction

The combined maximum revenue at risk for Kraft Heinz and General Mills due to the artificial dye ban is estimated at $5.6 billion, assuming a worst-case scenario where sales of all dye-containing products are lost or severely diminished. This figure reflects about 10% of Kraft Heinz’s $26 billion annual revenue and 15% of General Mills’ $20 billion revenue.

The financial risk also includes costs related to research and development, supply chain adjustments, and potential short-term sales declines if reformulated products are less popular. Market uncertainty is reflected in a roughly 16% year-to-date decline in both companies’ stock prices amid these changes.

Consumer Trends and Industry Response

Consumer demand for “clean label” products free from synthetic additives is rising, driven by health-conscious shoppers seeking transparency and natural ingredients. This trend supports the dye removal initiative and could help offset revenue losses by attracting new customers and boosting loyalty.

Retailers like Walmart’s Sam’s Club are also removing artificial colors from private-label products, signaling a broader industry shift. Competitors may accelerate their dye removal efforts to maintain market share and meet evolving consumer expectations.

Contrarian Views and Scientific Debate

Despite regulatory momentum, some industry experts and scientists argue that the evidence linking artificial dyes to health risks remains inconclusive. They caution against overregulation without definitive proof, emphasizing consumer choice and the cost implications of reformulation.

This debate highlights the challenge of balancing food safety, scientific uncertainty, economic impact, and consumer preferences in policymaking and corporate strategy.

Historical Context and Future Outlook

The artificial dye ban is part of a historical trend toward greater food additive regulation and consumer demand for natural products. Over the past decades, food manufacturers have gradually reduced synthetic additives in response to health concerns and market forces.

This shift is expected to drive innovation in natural colorants, reformulation technologies, and marketing strategies focused on transparency and wellness. Regulatory frameworks may also evolve to formalize standards for natural ingredients, reshaping the food industry landscape.

The Way Forward

Kraft Heinz and General Mills’ commitment to removing artificial dyes by 2027 marks a significant milestone in the food industry’s response to health, regulatory, and consumer pressures. While the maximum potential revenue loss is estimated at $5.6 billion, the impact may be minor due to existing dye-free portfolios and favorable consumer trends.

This move underscores the complex interplay between science, regulation, economics, and public health in shaping the future of food products. The companies’ efforts reflect a broader shift toward natural ingredients and clean-label transparency, likely influencing industry innovation and policy for years.

Discover more trending stories and Follow us to keep inspiration flowing to your feed!

Craving more home and lifestyle inspiration? Hit Follow to keep the creativity flowing, and let us know your thoughts in the comments below!