By mid‑2025, KFC’s business was in full retreat. U.S. same-store sales slipped (down about 5.2% in 2024), and Q1 2025 data showed U.S. comps still negative (–1%). Customer sentiment had soured: a Food & Wine–compiled Yelp survey put KFC a dismal 18th among America’s chicken chains, trailing fast‑rising rivals. Industry data show competitors thriving – Raising Cane’s sales surged 32% in 2024, and legacy brands like Popeyes and Chick‑fil‑A grew solidly.

KFC’s centuries‑old brand suddenly felt outdated to many consumers, setting the stage for what the company called a “comeback era.”

Fierce Fast‑Food Fight

The competition was nothing short of fierce. By the end of last year, newer chicken concepts and entrenched rivals had closed the gap. According to restaurant data, Raising Cane’s upended the rankings by overtaking KFC in U.S. sales (adding +32% growth in 2024), while Popeyes and Chick‑fil‑A added roughly 4–5%. In customer surveys, KFC was trailing Chick‑fil‑A even on satisfaction.

Fast-casual brands like Zaxby’s and Dave’s Hot Chicken were drawing adventurous younger eaters – consumers who now expect bold flavors and hype. Every day KFC stayed stagnant, it ceded more ground. As one industry analyst put it, “There’s really no room to coast. The chicken wars are on.”

Listening to Fans

Faced with this slide in fortune, KFC’s leadership publicly acknowledged the need for change. The newly promoted U.S. president, Catherine Tan-Gillespie, spoke of a “personal” mission to restore KFC’s place on “the fried chicken podium”. She repeatedly framed the comeback as customer-driven: “We’re well aware of the latest fried chicken rankings,” Tan-Gillespie told reporters, and vowed to “launch a bold Kentucky Fried Comeback and remind America exactly who we are”.

In interviews, she promised to put “fans at the forefront” and be “more food-obsessed” about quality and menu variety.

Strategic Reset

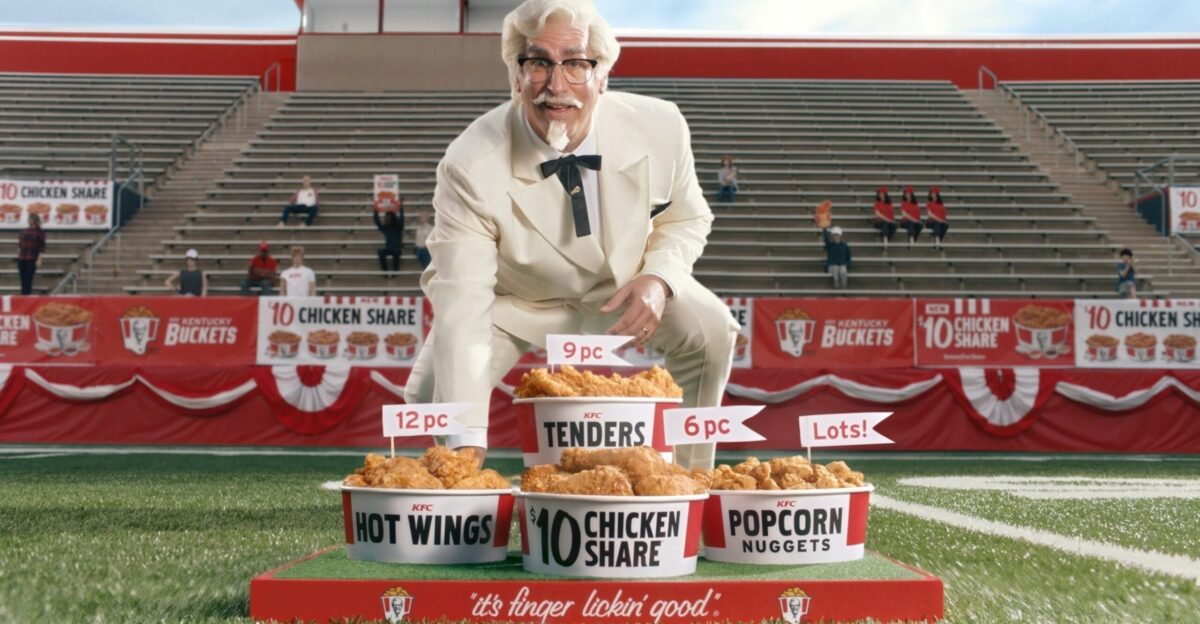

Internal cues echoed this urgency. KFC notably revamped its mascot imagery: Colonel Sanders went from smiling grandfather to steely taskmaster. Store signs and billboards suddenly showed a frowning Colonel — a visual shorthand that “the Colonel would not be happy about our market share”. This hard‑edged tone carried into a dramatic new ad campaign called “The Colonel Lived So We Could Chicken,” which frames Sanders as a tireless “chefpreneur” obsessed with perfecting the recipe.

In one cinematic spot, Sanders (played by chef Matty Matheson) reenacts explosive fryer mishaps and kitchen showdowns just to nail those 11 herbs and spices.

The Kentucky Fried Comeback

The centerpiece was a bold promotion. Dubbed the “Kentucky Fried Comeback,” the campaign kicked off with a nationwide Free Bucket on Us offer. Any KFC Rewards member who spends $15+ via the app or website gets a free 8‑piece Original Recipe chicken bucket (or tenders) — no catch beyond joining the rewards program. The goal was literal taste-testing: KFC asked customers to sample the chicken and provide feedback.

As Tan-Gillespie quipped, “If people can give their ex a million second chances, I hope our fans can give us one…your first bucket’s on us.”.

Menu Makeover

The comeback era wasn’t just about free food. KFC leaned into menu innovation and nostalgia alike. First up: fried pickles and “Comeback Sauce.” A nod to popular appetizer trends, KFC introduced golden‑fried dill pickle chips served with its brand‑new tangy “Comeback Sauce” (or ranch). At the same time, it brought back its venerable value meals: the famed $7 “Fill Up” combos returned to menus nationwide. These moves played into KFC’s pledge of being “flavor‑obsessed.”

As a lifestyle writer noted, the chicken itself was unchanged — KFC’s famous Original Recipe was the focus — but the sides and savings offered more buzz.

Marketing Blitz

On the marketing front, KFC poured on the gas. After years of relatively subdued advertising, the Colonel dominated new ads and social posts. The cornerstone creative was a short film entitled “Obsession,” which dramatized Sanders’ legendary recipe as a heroic quest. Celebrity chef Matty Matheson co‑starred, grilling chicken in an intense fashion while Sanders sternly oversaw the process. KFC also updated its social media: the Colonel on Instagram sported a serious glare and hashtags like #KentuckyFriedComeback.

Retail media placements included high-profile sports tie‑ins (e.g. MLB on Fox) and even a collaboration with the “1111 Challenge” – a viral treasure hunt promising 11 months of free KFC to those who decode clues hidden in the new ad.

Employee & Franchisee Response

Behind the scenes, franchisees and crew members report a surge of chatter. “At first we were skeptical, but people are actually talking about KFC again,” said one multi-unit franchise owner. Store managers describe modest upticks in traffic whenever the free bucket offer pops on screens, even customers who hadn’t visited KFC in years. “I’ve been here 10 years and I’ve never seen the phone ring so much,” laughed a South Carolina restaurant manager.

Front‑line employees note younger patrons showing up specifically for the ‘free chicken’ deal or the fried pickles.

Measuring Early Impact

The results are coming in trickles. So far, store‑level performance has been mixed. In markets with many high schools and offices, lunch and dinner peaks have picked up slightly; at mall food courts, foot traffic has seen minor lifts. However, at the national level KFC’s U.S. sales are still in a trough. Yum! Brands’ financial reports show KFC U.S. same-store sales down about 1% in the latest quarter. By contrast, KFC’s international business (89% of its restaurants) grew roughly 3%, highlighting that any U.S. gains will be diluted globally.

Analysts point out that all fast food chains use big promotions, so the real question is sustaining momentum. One retail consultant noted, “Promos bring people in, but you only know if a brand is truly recovering when sales trends turn positive on their own.”

Future Stakes

KFC’s comeback era is a make-or-break moment. The brand has signaled that this isn’t a stunt but a strategy overhaul: beyond free buckets, it reorganized leadership and even moved KFC’s U.S. headquarters to Texas in early 2025 to drive growth. The stakes are clear – if customer sentiment and sales don’t turn around by year’s end, competitors will view KFC’s attempt as a failed Hail Mary. Industry veterans emphasize that KFC has strong assets (familiar menu, global footprint, beloved founder icon), but execution will be everything.

As one fast‑food analyst put it, “It’s a bold swing, but KFC will only win long term by keeping food quality high and delivering consistently on these promotions.”