On the same day the U.S. and China announced a 90-day pause in their escalating trade war, India quietly signaled its own discontent. On Monday, May 12, India submitted a formal notice to the World Trade Organization (WTO), indicating its intent to impose retaliatory tariffs on American goods. This move, invoking rights under the WTO’s Agreement on Safeguards, responds to U.S. steel and aluminum tariffs that affect approximately $7.6 billion worth of Indian exports.

While specific products haven’t been named yet, India’s 2019 response to similar U.S. tariffs included duties on 28 American products, ranging from almonds and apples to chemicals. This historical precedent suggests that a wide array of goods could be targeted again, potentially impacting American consumers.

So, what does this mean for American shoppers? As trade tensions simmer, items that previously escaped the fray might soon feel the heat, leading to possible price increases on everyday products.

Let’s unpack what’s really going on…

Why India’s Tariff Move Shakes Up Global Trade

India’s retaliation comes after the Trump administration’s extension of 25% tariffs on steel and aluminum imports in March 2025. India claims the U.S. tariffs violate WTO rules, justifying their counter-tariffs. This tit-for-tat strategy signals a deeper trade war, unsettling global markets and disrupting supply chains. The next negotiation phase, starting May 17, 2025, will be critical in setting the tone for future trade relations.

The Real Price Tag for American Shoppers

Tariffs already hike prices on many imported goods. Federal Reserve data shows U.S. import duties caused a 0.3% rise in core goods prices early 2025. With India targeting $1.9 billion worth of U.S. products, Americans will face higher costs on apparel, footwear, and food items. These price increases hit everyday consumers, squeezing household budgets and fueling inflation concerns.

Jewelry Prices Might Be the First to Jump

India’s jewelry industry, which polishes 90% of the world’s diamonds, faces U.S. tariffs that could raise prices for Americans. With over $10 billion in exports at stake, experts warn of sharp declines. Already hit by weak Chinese demand, the sector braces for more pain—impacting engagement rings, earrings, and luxury goods as economic tensions escalate.

How Businesses Are Scrambling to Adapt

U.S. retailers and importers are racing to adjust prices and supply chains. Many companies have paused Indian product orders to avoid surprise costs, while others hike prices to cover tariffs. Walmart and other giants are cautious about financial forecasts amid uncertainty. Increased inventory costs and alternative sourcing efforts add to operational expenses, which eventually trickle down to shoppers.

Stockpiling and Shifting Consumer Behavior

Many Americans are stocking up on goods with longer shelf lives, echoing pandemic panic buying. Shoppers like Thomas Jennings are doubling purchases of staples like beans and flour to avoid future price spikes. Economists estimate these tariffs could cost $3.1 trillion over a decade, around $2,100 per household, deeply affecting consumer confidence and spending patterns.

Supply Chains Under Pressure and Changing Fast

The tariff conflict is forcing companies to rethink sourcing. Textiles, jewelry, and other sectors heavily reliant on Indian imports are shifting production elsewhere or automating to cut dependency. Pharmaceuticals remain exempt, but most industries face higher costs and complex new supply webs. This reconfiguration increases overall product prices and disrupts market stability.

India’s Bigger Economic Strategy Behind the Tariffs

India’s retaliatory tariffs aren’t just political—they’re strategic. As the world’s second-largest steel producer, India is protecting its export markets while controlling domestic supply with its own tariffs on steel imports. By reserving the right to escalate, India leverages its position to negotiate a better trade deal, seeking to reduce the tariff gap with the U.S.

American Almonds and Apples Could Be Targets Again

India hasn’t named U.S. products it’ll target, but past tariffs on almonds, apples, and chemicals offer clues. These duties hurt American exporters before and could again. Almond and apple exports were set to surge in 2024–25—now at risk. If agriculture is hit, grocery prices may rise, with political fallout likely in key U.S. farming regions.

What These Tariffs Could Mean for Your Grocery Bill

If India retaliates, U.S. prices on imports like spices, textiles, jewelry, and leather could rise—analysts estimate a 1.3% overall increase. Spices alone may jump 15–20%, with India having exported $364 million worth in 2022. Diamond jewelry, tough to replace at scale, could also spike. Even small buys like turmeric may sting as trade tensions deepen.

Behind the Dispute: A $131 Billion Trade Powerhouse

This clash isn’t just tit-for-tat—it’s a standoff between major trade powers. U.S.–India trade hit $131.84 billion in 2024–25, but America’s long-standing deficit frustrates Washington. Now, businesses are uneasy. Some, like spice importers, are eyeing Egypt and Peru over India. As suppliers shift, what once felt like a stable relationship is growing more volatile—with deadlines fast approaching.

A Domino Effect: Other Countries Join the Fray

India’s bold response has emboldened others. Japan, the EU, and Britain have notified the WTO about retaliatory measures against U.S. tariffs on steel, aluminum, and autos. This growing global resistance risks sparking a domino effect of tariff tit-for-tat, threatening worldwide trade flows. China recently negotiated a temporary tariff cut, showing potential paths for easing tensions.

Small Businesses Feel the Squeeze the Hardest

Small American retailers struggle most with tariff fallout. Lacking the scale to absorb costs or negotiate alternatives, many face closure or painful price hikes. British beauty retailer Space NK and Vancouver’s Understance have halted U.S. shipments to avoid tariff confusion. For small businesses reliant on Indian imports, survival means tough choices that may limit product variety for consumers.

How “Made in America” and “Made in India” Are Shaping Consumer Culture

Tariffs are changing how Americans see products. “Made in America” labels are now marketing tools justifying higher prices, while “Made in India” items are rebranded as luxury or specialty goods. Social media buzz shows shoppers proudly displaying stockpiled products, creating new cultural divides between those who can afford rising costs and those who must cut back.

Media Amplifies Consumer Worries and Political Pressure

Coverage of India’s tariff retaliation has heightened anxiety nationwide. Inflation memes and price comparisons flood social media, driving consumer fear. With 75% of Americans citing tariffs as a major economic concern, inflation forecasts are at their highest since 1981. This pressure pushes politicians to seek quick resolutions, even as panic buying feeds into economic uncertainty.

Wedding Apparel Shows Unexpected Ripple Effects

The tariff impact extends to cultural markets like Indian wedding garments, which face up to 28.2% cost increases. Specialty shops in Chicago report customers traveling to Canada or Mexico for purchases or delaying ceremonies. This niche crisis highlights broader effects on ethnic communities and specialized industries disrupted by trade tensions.

Environmental Cost of Supply Chain Changes

As companies reroute shipments through third countries to avoid tariffs, shipping distances and carbon emissions rise. Yale’s Budget Lab reports tariff-induced product substitutions sometimes favor less eco-friendly options. Domestic manufacturing growth, while promising, accelerates resource use and may sidestep environmental reviews. The net effect is a temporary spike in the carbon footprint of consumer goods.

Labor Market Ripples: Jobs Gained and Lost

Tariffs shift jobs unevenly. Protected industries see modest gains, but overall employment falls. Yale projects 456,000 fewer payroll jobs and a 0.4% rise in unemployment by year-end 2025. Service sectors tied to international trade suffer most. Regional disparities grow, with manufacturing hubs gaining jobs but port logistics losing, forcing workers into tough career transitions.

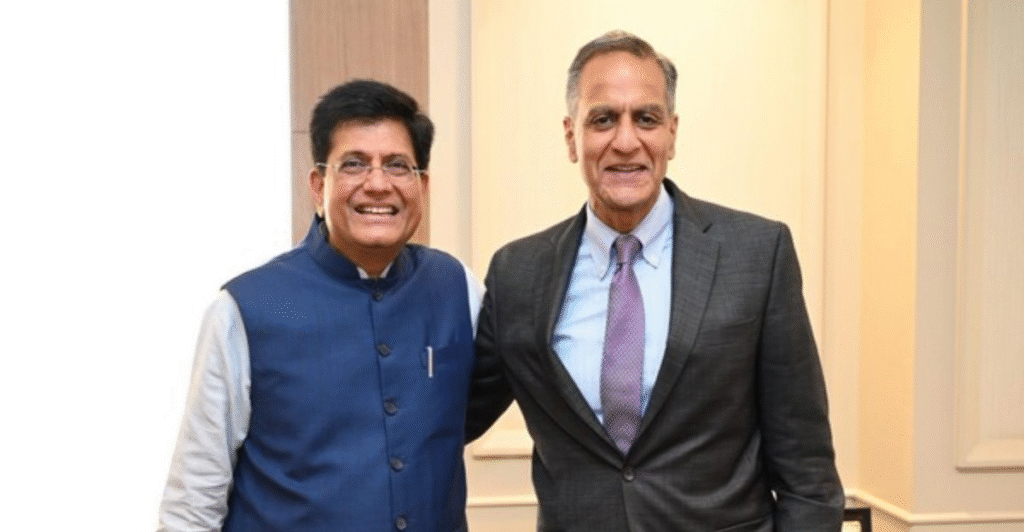

Talks Are Heating Up in Washington, Fast

India is racing to avert tariffs. Commerce Minister Piyush Goyal meets U.S. negotiators May 17–20, offering to cut its average tariff gap from nearly 13% to under 4%, a bold two-thirds reduction. Both sides aim for a deal before the 90-day pause ends in June. If talks fail, tariffs hit, and prices for millions of Americans could rise fast.

India Makes Its Move Amid a Shifting Global Order

India’s retaliation comes as global trade shifts fast. The U.S. and China just slashed tariffs—dropping some U.S. duties from 145% to 30%—raising fears Chinese goods could flood U.S. markets. Meanwhile, India’s new free trade pact with the UK cuts duties on 90% of British goods. As alliances realign, India is fighting to stay competitive and keep exports afloat.

What This Trade Fight Says About the Bigger Picture

This isn’t just about tariffs—it’s about leverage, diplomacy, and the global rules that shape what ends up in your cart. India’s first retaliatory move during Trump’s second term signals a new phase of economic assertiveness.

For American shoppers, the short-term risk is higher prices. But longer term, it could spur overdue trade reforms. A fairer deal could mean lower barriers, more competition, and better prices. The next few weeks are critical.

How this plays out may redefine U.S.–India trade and show how quickly global policies can ripple through everyday purchases, from groceries to gifts. One thing’s clear: this fight is personal.

Discover more trending stories and Follow us to keep inspiration flowing to your feed!

Craving more home and lifestyle inspiration? Hit Follow to keep the creativity flowing, and let us know your thoughts in the comments below!