Ford’s abrupt halt of production at several American plants is shaking the entire auto landscape. This is simply just a logistics hiccup — it is a signal of deeper vulnerabilities for workers, car buyers, suppliers, and even the global economy.

The consequences will ripple outward, triggering shortages, price increases, and exposing fundamental weaknesses in American manufacturing.

Rare Earth Crisis

According to Bloomberg News, Ford CEO Jim Farley cites a critical rare earth mineral shortage—caused by recent Chinese export restrictions—as a direct cause for the strategic freeze.

“It’s day to day. We have had to shut down factories. It’s hand-to-mouth right now,” Farley explained. The new export regime from China—a provider of over 90% of global rare earths—has upended Ford’s procurement cycles and left production lines idle.

Dealer Showrooms Face Drought

Showrooms are under pressure as new Ford cars disappear from lots. This will lengthen delays and cause price increases for in-demand trucks and SUVs.

The dealers are reducing test drives, holding back key models, and focusing on high-margin sales. For prospective buyers hoping for summer deals, these shutdowns signal that time and affordable inventory are rapidly running out.

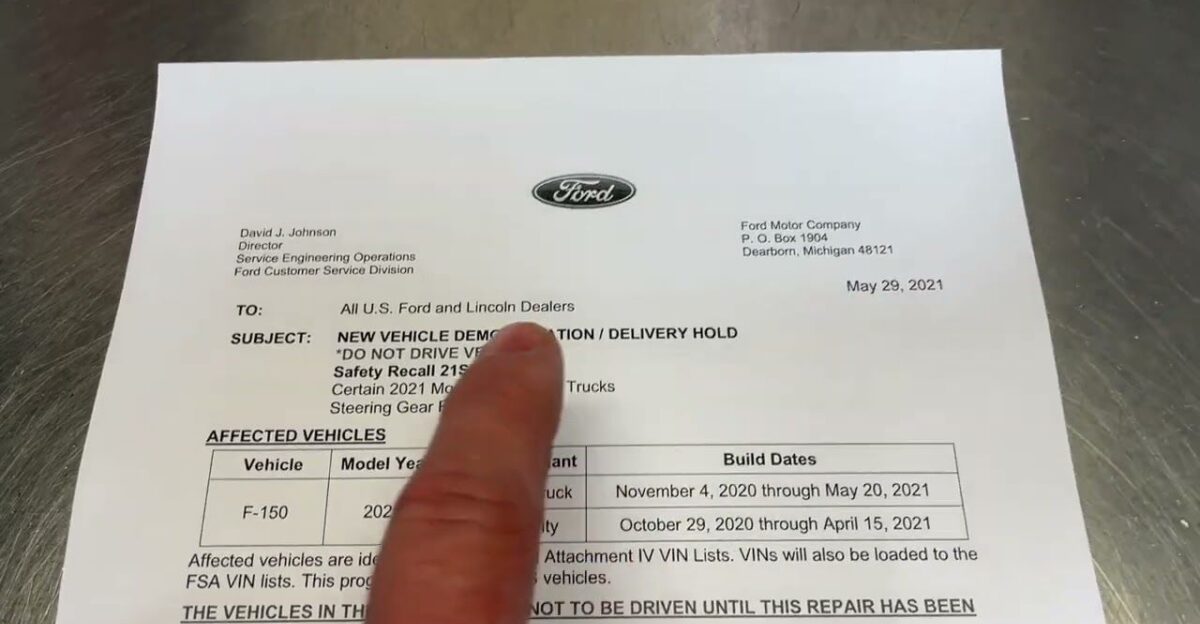

Quality Concerns Fuel Consumer Distrust

Feedback from Ford insiders and customers reveals growing distrust in vehicle quality. “Supervisors are telling us the product is junk. Union workers don’t care about pride or quality,” one local employee commented.

The pattern is reflected in the surge of recalls, industry fines, and widespread consumer complaints about frequent breakdowns, even in vehicles less than five years old. Planned obsolescence and rushed assembly are recurring themes among dissatisfied owners.

Hefty Price: Beyond Reach for Most Americans

A base-model Ford F-150 now starts north of $39,000, and average monthly payments hover around $900, while fully loaded models go much higher.

While the median U.S. annual income is about $40,000, a working family doesn’t stand a chance of owning a new Ford.

“We’re not about to spend $90,000 on a truck that is having recalls all the time,” warned another prospective buyer. The affordability problem is severe and not unique to Ford.

Suppliers in Peril

The disruption extends deep into Ford’s network of parts suppliers. Hundreds of small businesses, from electronics to seat makers, are seeing orders dry up overnight.

That spells real danger: layoffs, furloughs, and financial insecurity for thousands far beyond Ford’s own workforce. The threat of permanent closures is real, amplifying economic pain throughout the supply chain.

Industry-Wide Shortage: Competitors Also Stumble

Ford isn’t alone: GM, Stellantis, and Toyota are also scrambling for rare earth supplies. Efforts to secure new sources — from domestic mining to recycling — are underway, but they are far from becoming a reality.

Industry-wide, production cuts and temporary plant closures can be expected as manufacturers scramble for the dwindling pool of eligible imports from China.

Trade Policy and Tariffs

Trade policies intended to strengthen U.S. manufacturing, including sweeping new tariffs, have backfired. According to CNN, recent tariffs have failed to create a jobs boom, but have led to higher prices and job losses in manufacturing.

Instead of bringing jobs home, the uncertainty has paralyzed investment, triggered layoffs, and led companies to automate or offshore critical roles further.

Used Market Surge: Opportunity or Trap?

With new inventory drying up, the used car market is heating up. Dealers report that prices for pre-owned F-150s and other popular models are rising.

While this gives sellers an advantage, it creates headaches for families seeking affordable and reliable transportation. Certifies pre-owned options hold appeal, but competition for decent used vehicles will intensify until production stabilizes.

Planned Obsolescence & Recall Culture

Comments from Ford buyers accuse Ford, as well as other automakers, of selling vehicles that are “at least 40% overpriced,” questioning why new models can’t last longer than five years.

This distrust is backed by Ford’s ongoing industry lead in recalls and significant fines issued by the regulatory agencies, both linked to recurring quality lapses. Critics ask, “Why should we accept planned obsolescence and pay more for less?”

Labor, Unions, and the Disillusioned Workforce

Thousands of Ford workers are grappling with reduced hours, furloughs, or permanent job losses. Union leaders warn of eroding morale and long-term instability as communities face economic aftershocks: closures of local businesses, and a decline in public services. The result is deep uncertainty for working-class families dependent on stable manufacturing jobs.

Political Uproar

Lawmakers on both sides are using the crisis to push for greater resilience. Prominent policy proposals have included federal subsidies for rare earth mining, stronger incentives for recycling, and the creation of national stockpiles of critical materials.

Congressional hearings are taking place, with broad agreement that the U.S. can’t afford such supply chain fragility in the future.

Workforce Transitions: The Vanishing American Job

Automation, offshoring, and the shift away from manufacturing work mean that many of the jobs lost during this crisis will not return.

“Years ago, 1,900 First American Mortgage Solution jobs disappeared in one call, all of them offshored,” as one commenter reminds us.

Even if auto jobs return, many American youths are no longer interested in careers in manufacturing, preferring tech, healthcare, or gig work.

The Consumer Dilemma: Wait, Buy, or Switch Brands?

Industry experts advise: If you truly need a new Ford, act fast—supplies may get much tighter, and prices will continue to rise.

Alternatively, consider other brands less exposed to rare earth shortages, or wait for the expected stabilization. But patience is a risk, too, as no one can predict how long the shortages and trade battles will last.

The Lesson—Fragility in a Globalized World

This crisis is a lesson in how interconnected and fragile modern manufacturing is. One disruption can balloon across continents, reshaping jobs, prices, and consumer choices.

As Ford’s emergency shutdown shows, the consequences extend far beyond company walls, forcing buyers, workers, and policymakers to reckon with the hard realities of today’s global economy.