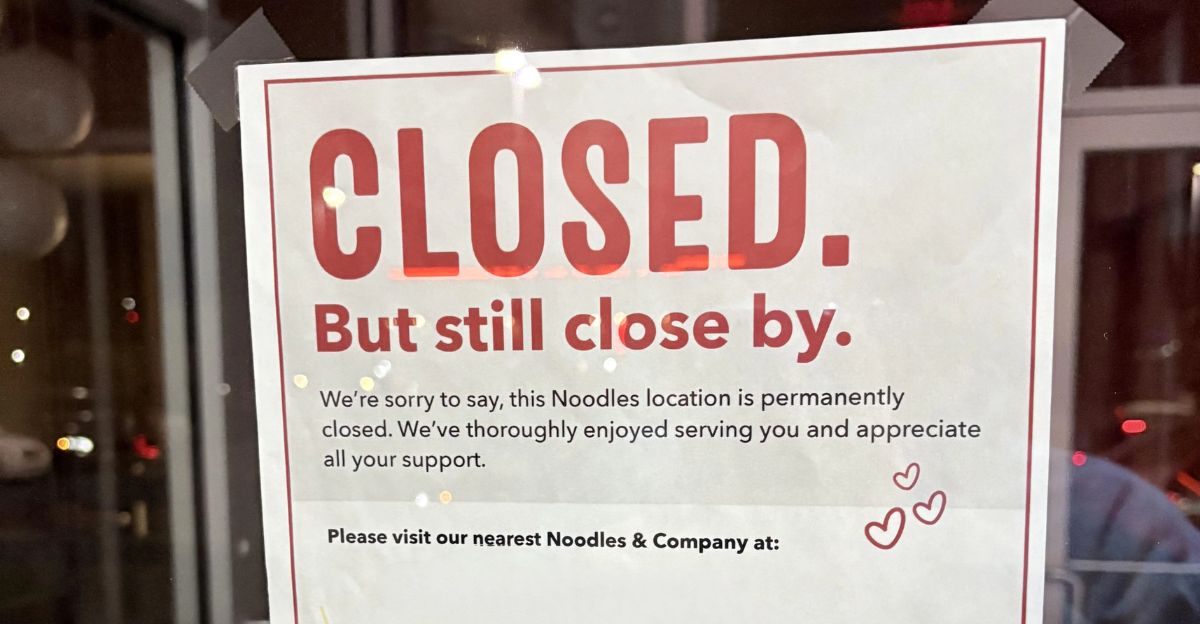

Another unpleasant announcement about Noodles & Company: The popular fast-casual chain with deep ties to the Midwest plans to shutter as many as 21 restaurants in the United States in 2025 to shore up its finances. The move is part of a wider wave of restaurant closings, as even long-dominant chains are not immune to the powerful economic forces battering the industry.

It’s an internal decision that the entire sector faces, as even established brands must change or die. For a loyal cadre of customers and workers, each is an emotional and economic landmark, pointing to a new era for American dining habits and the resilience of its food industry.

Breaking Down the Store Closures Across Regions

The closures focus on lower-performing stores, affecting the chain’s footprint most notably in Iowa, Illinois, and Wisconsin. Twenty-one closures are a sliver of its national presence, but they’re a big hit for those local communities and workers.

The company’s first-quarter earnings report includes the Noodles & Company announcement, highlighting a shift in focus from growth to profitability. The tactic is popular amongst midlevel chains, as chain restaurants like Hooters and Red Robin are losing dozens of locations as they continue to buckle under financial strain.

Why Financial Pressures Are Hitting Hard Right Now

Industry analysts cited several factors driving the closures, including a tight labor market, inflation, and shifts in consumer spending patterns. The fast-casual category, once a paragon of low prices and convenience, now contends with compressed margins as expenses increase faster than sales.

The National Restaurant Association reported that most operators say they have turned to higher labor costs for sales than before the pandemic, which makes profitability unrealistic except for the most efficient operations.

The pressures are causing chains of all sizes to make complex calculations, often to the detriment of loyal communities and employees.

How Changing Habits Are Reshaping the Dining Experience

Post-pandemic, diners are more cautious and value-minded. Financial stress, continued health concerns, and the shift to delivery and meal kits redefine how and where people eat.

Analysts say that as memories fade of life under lockdown, the move toward cooking at home and digital convenience is here to stay. For fast-casual chains, that means fewer trips to the store and an increased reliance on takeout and delivery, which can often be less profitable and more logistically challenging than sit-down service.

The Impact of Working from Home on Restaurant Foot Traffic

Employers across the country can’t force people to dine (as opposed to gather), and remote work from home has irrevocably changed the contours of restaurant activity, especially in urban areas and business districts. Lunchtime foot traffic continues to drop as fewer office workers commute daily, hitting fast-casual chains especially hard.

Now, Noodles & Company and chains like it are rethinking their real estate strategies, targeting suburban and residential areas as demand remains more stable. That strategic pivot is part of a wider urban exodus and shifting work patterns with potentially far-reaching implications for commercial real estate and local economies.

How Inflation and Supply Chain Issues Quietly Raise Costs

Supply chain disruptions and food inflation only added to the complexity. Although total restaurant sales have recovered, ingredient, packaging, and logistics costs remain high. Most chains have absorbed those costs instead of passing them on through price increases, further compressing margins.

The issues are even more pronounced for specialty operators and those dependent on particular ingredients, such as plant-based or specialty foods, compelling some to close units or leave the market altogether. These stresses are not unique to Noodles & Company but reflect the overall issues in the industry.

The Ripple Effect on Employees and Neighborhoods

Each restaurant closure results in lost jobs and reduced economic activity for communities.

Research by the Restaurants Association of Ireland shows that, on average, each closure loses 22 direct jobs and 13 indirect jobs, with significant knock-on effects for suppliers, service providers, and local returns to the taxman.

American figures can fluctuate, but the pattern holds: closures have a ripple effect, affecting employees, the broader community, and the regional economy.

Is the Industry Resetting or Simply Pulling Back

Others in the business argue that closures are not a sign of failure but of the need to reignite. Eliminating unprofitable locations will enable the chains to direct funds to successful territories, spend on digital reinvention, and improve the customer experience.

This “right-sizing” is a path to profitability, even if it causes short-term pain to impacted communities. The challenge is maintaining a healthy financial picture while maintaining the integrity of the brand and the welfare of the employees—something many chains are now trying to figure out.

Understanding If This Shift Marks a New Beginning or a Step Back

What’s next: Fast-food chains will have to adapt or die. That means getting used to using technology, constructing supply chains, and changing the format of stores to match changes in consumer demand.

Profit pools will accrue to those delivering value, effortless shopping, and an amazing in-store/digital experience. For Noodles & Company and other close competitors, the most recent round of store closures is a wake-up call to their customers regarding the value of the product they provide and a wake-up call for fast-food chains to evolve.

o action—an opportunity to reimagine themselves for a new era of dining, when agility and customer fanaticism are essentials.

What the Current Shakeup Means for the Future

Closing 21 Noodles & Company locations represents only a small example of the challenges confronting the fast-casual industry. Financial pressure, shifting consumer behaviors, and the pandemic hangover are all driving chains to make these tough calls.

Though closing restaurants poses challenges, it also offers a chance to reimagine and innovate. The future belongs to those who can reinvent themselves, support their people, and be sensitive to the needs of a changing market. For now, the industry is entering a crossroads with little else to proceed but reinvention and perseverance.

Discover more trending stories and Follow us to keep inspiration flowing to your feed!

Craving more home and lifestyle inspiration? Hit Follow to keep the creativity flowing, and let us know your thoughts in the comments below!