China’s economy—which previously had a reputation as the driver of international growth—is now struggling against trends that may hinder its progress.

Behind the statistics, however, lies a perfect storm: $10 trillion of concealed debt, a housing bubble of biblical proportions, and tens of millions of unemployed individuals.

Governments, investors, and citizens worldwide are nervously observing. It’s the quiet before a possible financial storm—and the result might shake the system globally in a way we haven’t witnessed since 2008.

The Unknown Burden

Most don’t know how much local governments in China owe—because much of it is not technically recorded. Local governments and provinces used shadowy financial subsidiaries called Local Government Financing Vehicles (LGFVs) to borrow trillions to finance their frenetic growth.

The catch? Those enterprises did not always generate sufficient profits. Now, due dates are approaching, and some estimate that more than $10 trillion is mixed up in obligations, and no one knows how to organize it all.

A Property Market on Life Support

China’s property market previously accounted for almost 30% of GDP. It’s currently keeping the economy alive. Hundreds of giant developers—such as Evergrande and Country Garden—have defaulted, with tens of millions of units in the pipeline and families in limbo.

Purchasers no longer trust pre-sale deals. Without that belief, construction comes to a standstill, consumer confidence collapses, and cities become filled with ghost towers and investment shells.

The Human Cost: 70 Million Jobless

Official unemployment statistics only tell half the story, but when you include youth unemployment, being underemployed, and the rural migrants sent back home, the number balloons—some estimate it at well over 70 million.

Graduates drive delivery vans. Tech job losses swell. The once-thriving urban middle class is in the squeeze. When millions cannot work, frustration grows, and social cohesion breaks down.

Deflation: The Silent Threat

China is heading into dangerous ground—deflation. Commodity prices are dropping, something that sounds great for consumers but is alarming for economists. It indicates people aren’t spending.

Wages aren’t rising. Companies can’t expand. The economy slows further. It’s an auto-catalytic trap Japan was stuck in for decades, and China may be heading down the same road, but with more debt.

Stimulus Without Spark

The government poured trillions of yuan into the system to stabilize it—buying land, recapitalizing local banks, relaxing credit. Yet growth has not come back as anticipated.

Why? Because the actual problem isn’t the absence of money—it’s the absence of confidence. Consumers are saving, not consuming. Builders aren’t constructing. Companies are waiting. The engine is flooded, not revved up.

Aging Fast, Growing Slow

China’s labor force was the best-kept secret of the last three decades. Now, though, the population is declining, and the shrinking labor force is aging. Birth rates are at historic lows.

In 2050, almost one-third will be over 60 years old. This is the population time bomb, or, more accurately, fewer workers, greater healthcare expenses, and smaller economic output while debt mounts and young adults cannot find work.

Cracks in the Banking Wall

Chinese banks, solid and state-supported for so long, now risk collapse. Small regional banks hold bad loans on local government and property debt. Some are consolidating, others quietly disappearing.

Citizens are beginning to lose faith in the banking system. Should there be a bank run—just one province—it could become a chain reaction Beijing is powerless to stop.

Global Trade Repercussions

China is not just a regional player—it’s highly enmeshed in world supply chains. If it decelerates drastically, ripple effects could affect raw materials, electronics, shipping, and manufacturing.

Countries reliant on Chinese demand—Australia, Brazil, and most of Africa—would be hit first. The modern world economy is so intertwined with China that a deceleration might push world growth into recession.

Technology as the Escape Hatch?

China has placed big bets on technology as an antidote to slowdown economics. The new bets are electric vehicles, artificial intelligence, semiconductors, and clean energy.

However, American sanctions, talent shortages, and excessively challenging industrial ambitions complicate that route. Will innovation make up for lost growth from property, exports, and demography? Or is it another costly gamble with uncertain payoffs?

Consumer Confidence Collapse

Ready and willing to spend and invest, Chinese consumers are now retreating. Savings rates are increasing at breakneck rates. Parents fear losing their jobs.

Young adults postpone marriage, children, and homeownership. A psychological flip is occurring—spending today is unprofitable, not risky.

Even luxury brands are seeing their Chinese sales collapse. It will take more than tax reductions or bailouts to restore confidence.

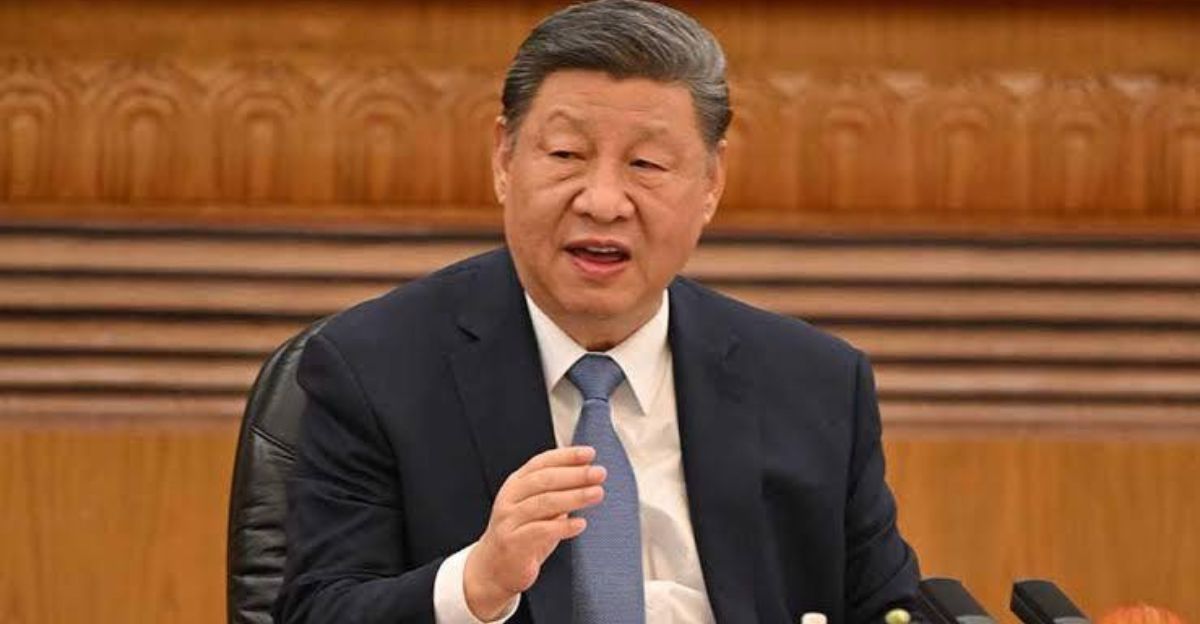

A Politically Fragile Moment

Xi Jinping has consolidated authority more than any leader since Mao, but that also means he owns the repercussions. Protests, though small and spasmodic, are gradually growing more frequent—from mortgage boycotts to anti-lockdown demonstrations.

In a society in which voices of dissent are rarely heard, even small fires have tremendous potential to ignite. As the economy loses steam, public tolerance could fray thinner than policymakers expect.

If the Collapse Comes

A complete collapse is not likely, but if it were to occur, this is how it would happen: simultaneous bankruptcies, frozen bank accounts, deflation traps, countrywide protests, and international market panic.

China’s government would come in forcefully and quickly—but even then, confidence-destroying damage, both at home and abroad, would take years to repair. This is not only a China problem—it’s everybody’s problem.

Still Time to Stabilize?

The outlook is grim, but not desperate. China still has its tool kit: foreign reserves, state bank control, and policy space. What it needs is time.

Short of actual reform—above all on local debt, labor markets, and consumer attitudes—gradual decline can precipitate collapse. The world is attentive, and the warnings have been flashing red.

Discover more trending stories and Follow us to keep inspiration flowing to your feed!

Craving more home and lifestyle inspiration? Hit Follow to keep the creativity flowing, and let us know your thoughts in the comments below!