California’s fast-food sector saw an unprecedented downturn in 2024. A new NBER analysis estimates roughly 18,000 fast-food jobs disappeared in just the first year of the law – about three lost jobs per hour statewide.

This wholesale contraction was virtually unmatched in recent history.

The findings quantify warnings by franchise owners: the dramatic $20 wage floor may have lifted some paychecks, but at the cost of thousands of entry-level positions.

Advocates and critics alike now frame this as a test of whether aggressive wage hikes uplift workers or eliminate their jobs.

Numbers Crisis

The statistics are striking. Fast food employment in California fell about 3.2% below its expected level after the wage law, while the same sector outside California grew roughly 0.1%.

In other words, restaurants in the state saw sharp cuts while nationwide fast food job counts inched upward. This divergence was concentrated at major chains (the very businesses targeted by the law) and far exceeded typical minimum-wage effects.

Economists note that a 3.2% drop is historically large for such a short window, highlighting the policy’s unintended consequences.

Political Backdrop

The fast-food wage hike stemmed from a hard-fought compromise. In 2022 and 2023, strong labor organizing (led by the fast-food workers’ union and SEIU) collided with industry resistance.

Proponents had pushed a broad “FAST Act” for sectoral bargaining, but after threats of referenda and lawsuits, the two sides settled on a law raising wages to $20 for big chains.

Governor Newsom signed Assembly Bill 1228 on September 28, 2023, specifically covering chains with 60+ locations and creating a new Fast Food Council to set industry-wide standards. Provisions exempted small bakeries and convenience outlets.

Labor leaders hailed this as historic progress for low-paid workers, even as franchisees warned of pain to come.

Industry Pressure

Even before the law took effect, many restaurants braced for impact. Two large Pizza Hut franchisees announced they would shut down in-house delivery and lay off about 1,200 drivers across California, instead relying entirely on third-party apps.

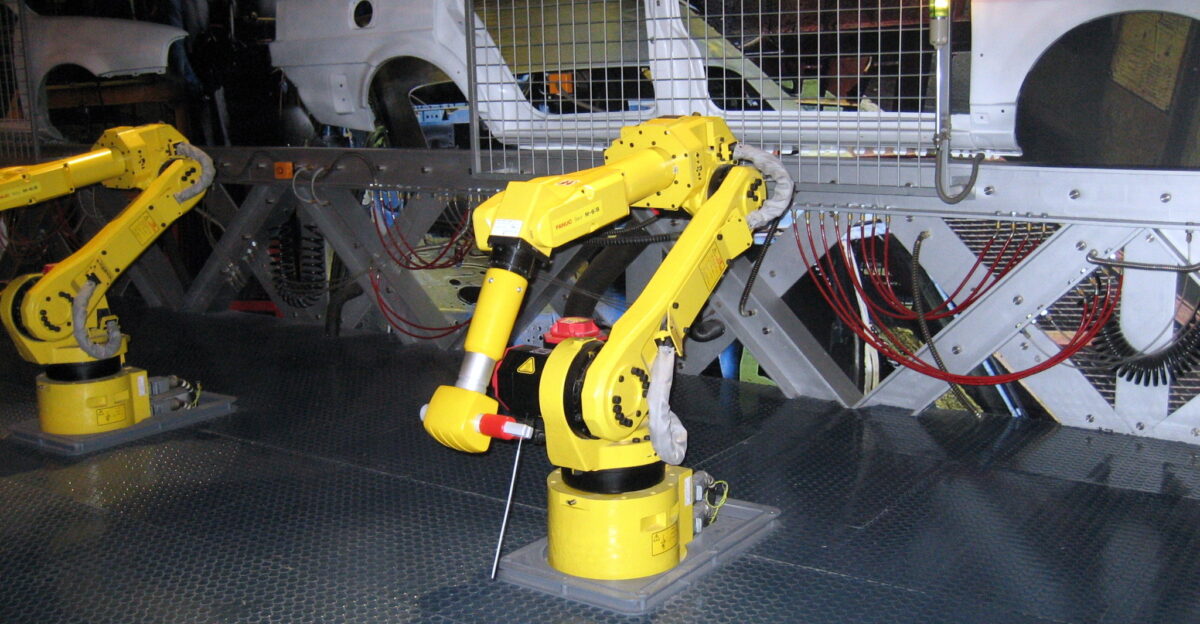

Chipotle accelerated its rollout of kitchen “cobots”: the new “Autocado” robot can cut, core and peel an avocado in about 26 seconds, and an automated makeline now portions bowls.

Chain operators also cut store hours, capped worker schedules, and froze hiring to offset costs.

One delivery driver who was laid off was quoted lamenting that the $400 severance “is a slap on the face” after years of service, underscoring worker frustration amid these cuts.

Research Revelation

By mid-2025 a detailed economic study delivered a clear verdict. Using government employment data (the QCEW) for September 2023–2024, researchers found California’s fast-food job count fell 18,000 below its trend.

In their words, “our median estimate translates into a loss of 18,000 jobs in California’s fast-food sector relative to the counterfactual”.

The analysis carefully adjusted for pre-existing trends and compared chains in California to those elsewhere, making it the most comprehensive assessment yet.

In short, the wage hike “increased wages substantially,” but also “employment…fell substantially,” findings that many experts regard as the definitive accounting of the policy’s impact.

Regional Fallout

The pain was felt unevenly across the state. Dense urban markets with many big-chain restaurants (Los Angeles, Orange County, San Bernardino, etc.) saw the deepest job cuts, as franchisees struggled with the uniform $20 wage in high-cost areas.

Even some rural outlets – where local costs are lower – reported losses. An industry analysis warned that under a 25% wage increase, “some fast food restaurants also closed” as profit margins evaporated.

Business groups say several outlets even considered permanent closure rather than lose money under the new law.

Overall, areas with the most covered restaurants absorbed the greatest layoffs, illustrating the uneven burden of the policy.

Worker Voices

“It’s super great,” says Sandra Jauregui of Sacramento, smiling after an 18‑year career at Jack in the Box. The new law boosted her pay from $17.50 to $20, meaning an extra ~$120 per paycheck and “some breathing room” on rent and bills.

But others have mixed feelings. Los Angeles cook Edgar Recinos notes that while he no longer skips meals, his regular hours were cut.

“When I don’t get to fill in to make up the time, I find myself ‘in the same situation before the (wage) increase,’” he told CNN.

These stories show the trade-offs: higher hourly pay for some, but fewer shifts and opportunities for many.

Automation Acceleration

Restaurants hastened their technology plans in response. California became a testing ground for labor-saving machines: for example, two Chipotles deployed the new “Autocado” robot and an automated salad-and-bowl dispenser.

Chipotle emphasizes these “cobots” assist rather than replace humans – indeed, the company’s rep notes they “will not eliminate any jobs,” but free crew members for other tasks.

Other chains rushed in self-service kiosks and AI drive-through systems years ahead of schedule.

In the words of one industry leader, rising labor costs have put operators at a “crossroads” of testing new robotics and automation to trim expenses.

Academic Debate

Not all researchers agree on the outcome. A Harvard/UC San Francisco survey study found that while wages jumped by roughly $2.50, there was “no evidence that employers turned to understaffing or reduced scheduled work hours”.

A UC Berkeley labor report likewise observed an 18% average pay increase with “no job cuts” and only small price rises.

Proponents cite these findings as evidence that the economy adjusted without major layoffs. But critics point out that those analyses used different data and shorter timeframes.

The discrepancy – between no-effect studies and the 18,000‑job finding – now drives a scholarly debate over methodology and the law’s true impact.

National Implications

California’s experiment is both an inspiration and a warning for other states. New York has already set a $16.50 fast-food minimum, and Illinois is debating sector-wide wage councils.

Oregon advocates want statewide fast-food wage boards, too. Fast-food employers say the California outcome “should raise alarm bells across the country”, – as McDonald’s USA president Joe Erlinger warned when the law passed.

At the same time, workers’ unions see a partial success story and push for more: even as California’s council considers adding 70¢ more (to $20.70 in 2025), labor leaders say this shows urgency in one of the nation’s most expensive states.

How many others follow California likely hinges on whether policymakers trust the NBER findings or the alternative studies as time goes on.

Consumer Impact

So far, the cost to diners appears modest. In the run-up to April 2024, many chains warned menu prices might rise 2–3% to cover higher pay.

Indeed, Starbucks, McDonald’s, Chipotle and others did add surcharges. But official data and surveys suggest price hikes were relatively small.

A UC Berkeley study noted that average menu prices rose only about 3.7% after the wage law – roughly $0.15 on a $4 burger.

Even the governor’s office cited figures of just 1.5% average price increases (≈$0.06 on a $4 sandwich).

Policy Controversies

The new law has also sparked confusion and controversy over exemptions. For example, a media report falsely claimed bakery-café chain Panera Bread would be exempt because it bakes bread onsite.

California officials quickly dismissed that as “absurd,” noting the exemption was meant only for true bakeries, not all fast‑casual restaurants.

SEIU’s fast-food director Tia Orr stressed there was never an intent to favor any one company by name – the carve-out was simply “clarity on what constitutes a fast-food establishment”.

Such battles over loopholes have created political noise even as the law unfolds.

Council & Union Push

Workers and their new council continue to press their case. The state’s Fast Food Council (an equal mix of labor, owners and officials) convened in early 2025 to consider a 70¢ raise.

Unionized fast-food workers held rallies and gave public comments.

One Bay Area worker, Verónica Gonzales, told council members through a translator, “I cannot live with this wage,” underscoring calls for even more support.

Meanwhile, many workers report real gains: San Jose Wienerschnitzel cook Selvin Martinez says the pay hike has been “life-changing”, enabling him to cover bills, help family, and even save after years of living paycheck to paycheck.

These voices highlight both the impact and the ongoing struggle behind the policy.

Beyond California

The California saga will influence debates nationwide. New York has raised its fast-food wage to $16.50 and instituted its own board for industry standards; Illinois lawmakers have introduced sectoral bargaining bills; and activists in Oregon and elsewhere cite California as precedent.

If major states like Florida or Texas consider similar sector-based wages, advocates on both sides will point to California’s experience.

As one conservative economist wrote, any bold minimum-wage policy “has some cost” and we must decide if it’s worth the trade-off.

In the meantime, unions in other cities (e.g. Seattle’s push for $17) watch closely, knowing that the efficacy of big wage hikes in fast food is now a live national question.

The Road Ahead

The debate is far from over. Even two years later, economists and policymakers disagree about the true effects of California’s law.

Future job and wage data will clarify which studies were correct. California’s Fast Food Council and Legislature will also play roles: a decision to add another raise (to $20.70 in 2025) could dampen calls to abandon the model.

But across America, the case has ignited questions about how to raise living standards without sacrificing entry-level opportunities.

California’s experiment illustrates the trade-offs of aggressive wage policy – and its ultimate legacy will depend on whether workers’ income gains or the job losses prove more lasting and significant.