Something spooky is brewing in the breakfast aisle. A set of vintage cereals tied to Halloween nostalgia has made a bold return, and this time, they’ve been reimagined with puppet-style mascots from Jim Henson’s Creature Shop. The limited-edition rollout is already drawing long lines, resale frenzy, and viral buzz. With the global cereal market on track to hit $78.9 billion by 2034, these old-school favorites are staging a monster comeback.

Fans Flock and Collectors Line Up

Snack influencer Snackolator pulled in 5,462 likes and 65 comments within 24 hours after sharing the first Walmart photos of the puppet cereal boxes on July 24, 2025.

Meanwhile, Walmart managers in Michigan and Texas told pop-culture site Conskipper that fans were lining up as early as 5 a.m. on launch day. Over on eBay, boxes quickly appeared for US$40, roughly eight times the standard US$4.98 shelf price.

Monsters’ Origin Story

These cult-favorite cereals first appeared in the early 1970s and quickly became household names. By 2009, General Mills moved them to Halloween-only releases, turning seasonal scarcity into part of the appeal. Over time, their limited return has sparked a loyal following across generations, fueled not just by breakfast nostalgia, but also by comics, collectibles, and exclusive merchandise drops.

Cereal Market Headwinds

Boxed-cereal sales in the U.S. fell from 2.5 billion units in 2021 to 2.1 billion this year, a 13% drop. Kellogg CEO Gary Pilnick told investors on May 6 that he expects further 2–3% annual declines as shoppers skip breakfast or seek cheaper options. Analysts blame busy lifestyles and sugar concerns. Monster Cereals avoid these pitfalls by thriving as collectibles before anything else.

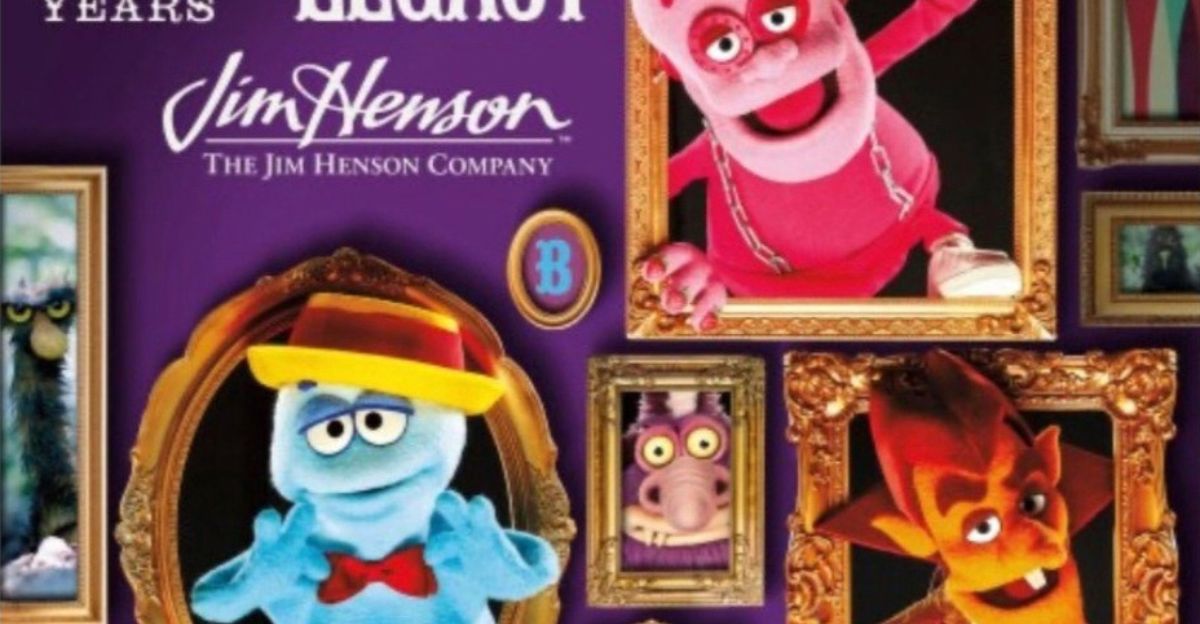

Puppet Premiere

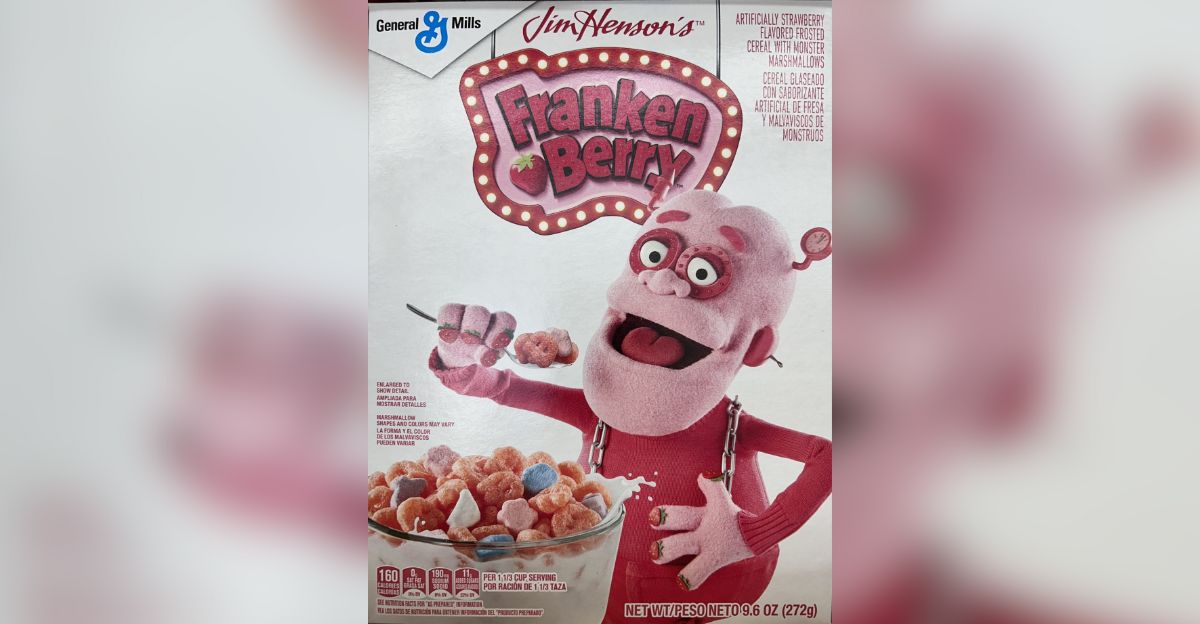

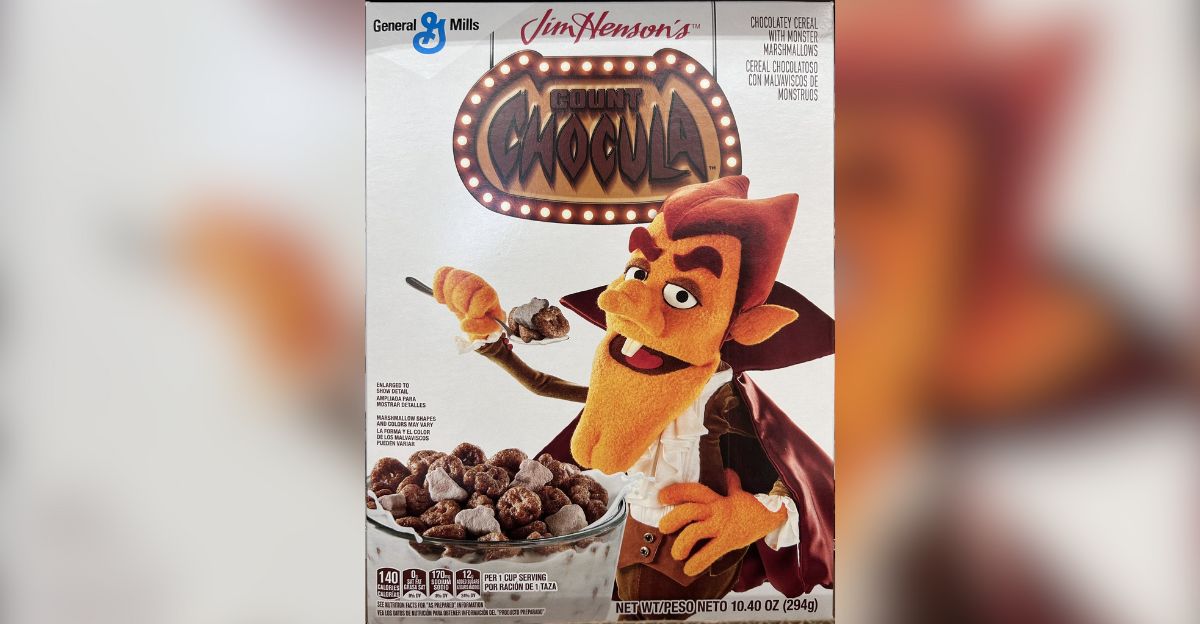

On July 18, 2025, fan site Muppet Stuff leaked photos confirming Jim Henson’s Creature Shop created puppets of Count Chocula, Franken Berry, and Boo Berry for General Mills’ fall campaign. Walmart sightings followed on July 24, verified by Suggest.com. It’s the monsters’ first live-action makeover in 54 years, paired with limited-edition boxes and new activations across TikTok, television, and in-store displays.

Where the Demand Is Hottest

Monster Cereals can be found in major retailers, including Walmart, Kroger, and Target. The Midwest, known for having the highest per-capita cold-cereal consumption in the U.S., is expected to lead the sales spike. Fans in cereal-loving regions often drive early demand, turning these limited-time releases into a seasonal ritual that blends nostalgia with anticipation.

Instagram Goes Wild

Snack influencer @Snackolator sparked a frenzy when he posted a photo of the new puppet boxes on Instagram. The post quickly racked up over 1,100 shares, with comments flooding in from fans reliving childhood memories. The viral moment captured how deeply tied these cereals are to online nostalgia, where even a single image can reignite decades of breakfast joy.

Competing for Breakfast

The battle for breakfast has gone mobile. Kellogg’s leans into convenience with on-the-go Frosted Flakes cups, while grain-free upstart Magic Spoon, now in over 20,000 stores after an $85 million raise, targets health-conscious shoppers. Meanwhile, General Mills rides the retro wave with its #MonsterMashRemix TikTok campaign, racking up more than 24 million views and tapping into the power of shared nostalgia.

Market Grows Globally, Shrinks Locally

According to Fortune Business Insights and Statista, the global breakfast cereal market is projected to reach $62.8 billion this year, growing at an annual rate of about 4.4%. In the United States, sales and production are falling by 1% to 2% each year as household breakfast habits shift, according to IBISWorld and Mintel. Analysts at Food Dive and Mintel say seasonal hits like Monster Cereals can’t reverse the long-term decline.

Resale Frenzy and Frustration

Limited-edition Monster Cereal boxes have become hot collectibles, with seasonal packaging driving demand. The 2024 glow-in-the-dark editions listed for up to $70, while 2025’s Jim Henson puppet boxes are already appearing online for $80 to $100. According to collectors, General Mills’ strategy of controlled scarcity builds hype each fall—but also sparks frustration when shelves run dry and resale prices surge, creating both excitement and backlash among fans.

Retailers Feel the Pressure

Seasonal Monster Cereal supplies are tight, and smaller retailers say they’re “last in line” after national chains place orders. According to Sloan Management Review, artificial scarcity can trigger “phantom ordering,” where stores overbook to avoid shortages, only worsening them. General Mills won’t disclose allocations but admits Halloween demand “regularly exceeds on-hand supply,” fueling friction between big-box chains and regional grocers.

TikTok-First Turn

Brand-experience director Mindy Murray says the Monsters team now creates content “for TikTok first, then other screens.” According to Digiday, General Mills has shifted 60% of its U.S. cereal ad spend into digital, three times more than five years ago. Duet challenges, short videos, and music stoke Gen Z nostalgia. Traditional TV still carries 40% of the spending but plays a secondary role in TikTok-led engagement.

Beyond the Bowl

The Monsters now anchor a broader Halloween range: Count Chocula Cookie Sandwich Kits, glow-in-the-dark Glo-Gurt, and Monster Mash Spooky Berry snacks hit stores nationwide. Spirit Halloween also lists 2025-exclusive plush mascots, the first official tie-in beyond grocery.

While General Mills won’t reveal sales goals, analysts expect strong gains across snacks and baking. According to DrugStoreNews, the Monsters are evolving from breakfast staples into seasonal lifestyle brands.

Sugar Scrutiny

A one-cup serving of Count Chocula contains 12 grams of added sugar, about 24% of the FDA’s recommended daily limit for adults. Critics and nutrition groups say nostalgic branding masks high sugar and artificial dyes like Red 40 and Blue 1. Euromonitor’s Tom Rees notes that while nostalgia draws interest, many now seek cleaner labels.

General Mills says it “continuously evaluates” recipes but hasn’t announced changes, per Food Business News. According to Mintel, a lack of reformulation concerns health-conscious shoppers, especially parents and younger consumers.

What’s Next for Monster Cereals?

Cold cereal sales have dropped over 13% since 2021 as younger consumers skip breakfast or grab protein bars instead. According to NielsenIQ, General Mills may respond by adding augmented reality to Monster Cereal boxes, building on this year’s QR giveaways.

While 2026 plans remain unconfirmed, the brand’s future hinges on whether seasonal nostalgia can outpace long-term category decline and keep these Monsters haunting shelves..