It starts with a few quiet cutbacks. A favorite dish vanishes from the menu. Hours shrink. Then one day, the lights go off for good. Across the country, award-winning restaurants are closing not because of bad food or poor service, but because the math simply doesn’t work anymore. Inflation and staffing shortages get the blame, but the real issue runs deeper.

As consumer habits shift and debt loads rise, even celebrated chains are struggling to stay afloat. One beloved fried chicken brand is now racing to raise $2 million just to survive.

What happens if it fails? And what does that say about the future of dining in America? The warning signs are here, but not everyone is looking.

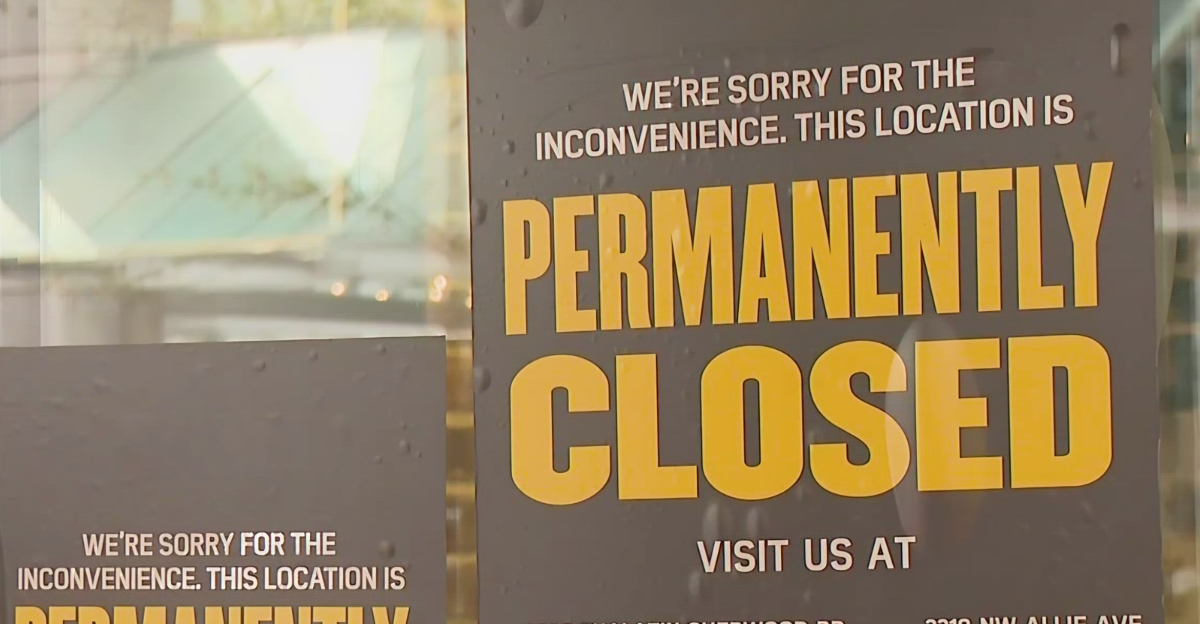

Restaurants Are Closing Everywhere, and Fast

From Manhattan to small-town strip malls, the trend is unmistakable: restaurants are collapsing coast to coast. In the first half of 2024, the services sector made up 28% of large corporate bankruptcy filings. Even chains earning over $20 million a year aren’t immune.

Red Lobster, TGI Friday’s, and Ruby Tuesday all filed for bankruptcy.

Wendy’s shut down 140 locations last year. This wave isn’t about poor management or isolated mistakes. It’s a reflection of a deeper, nationwide strain that’s affecting all types of restaurants. And the losses aren’t just financial, they’re reshaping neighborhoods and livelihoods. One case, though, is drawing particular attention for what it reveals about the industry’s fragility.

When Chicken Chains Were Thriving

Not long ago, opening a fried chicken joint felt like a safe bet. The early 2010s brought a boom in comfort food chains, and chicken led the charge. With premium sauces, better ingredients, and sleek branding, these spots became more than just restaurants; they were community staples.

Many believed fried chicken was recession-proof, a reliable crowd-pleaser. But as economic conditions tightened and operating costs ballooned, even the most promising businesses started to feel the squeeze. That optimism is now colliding with a much harsher reality.

Trouble Was Always in the Background

The pandemic didn’t break the restaurant industry, it exposed its weaknesses. Many businesses were running on margins so thin they couldn’t handle the slightest disruption. Labor costs surged, with 98% of operators saying expenses rose. Chicken prices spiked. Delivery apps demanded steep commissions.

Remote work meant fewer office workers grabbing lunch, while rents in prime locations kept climbing. These pressures didn’t go away after COVID restrictions eased, they hardened into a new normal. What once looked like short-term disruption now appears to be permanent. For many restaurants, the cracks had always been there. The pandemic simply widened them into chasms.

Sticky’s Is Down to Its Last Shot

Sticky’s Chicken Joint, a once-booming chain famous for bold flavors and viral buzz, is now fighting for survival. After filing for bankruptcy in April 2024, the company is pinning its hopes on a $2 million deal with Harker Palmer Investors. But that deal is under fire.

A Justice Department watchdog argues the terms give the buyer too much legal protection. If the court rejects it, Sticky’s will be forced into liquidation. The company’s legal team warned the fallout would mean no recovery for creditors and complete shutdown. It’s a stark illustration of how quickly fortunes can flip, even for chains with loyal followings.

The Collapse Hits the City Hard

Sticky’s operated a dozen locations across New York and New Jersey, including seven in Manhattan below 45th Street. Those central locations once brought steady foot traffic, but the shift to remote work has drained their customer base. Now, instead of being assets, those high-rent spaces have become burdens.

Beyond lost meals, the closures affect an entire web of workers, delivery drivers, and suppliers. Reddit threads show stunned fans sharing memories and regrets. For many New Yorkers, Sticky’s was a hidden gem, gone just as more people were discovering it. The closures offer a glimpse at what may be coming for other chains in similar positions.

It’s Not Just Business, It’s People

Every bankruptcy means more than unpaid bills. It means lost jobs, upended lives, and shuttered dreams. Sticky’s had grown from a single location in 2013 to a $22 million brand by 2023. Now, hundreds of workers face unemployment. Franchise owners, investors, and suppliers like U.S. Foods may walk away with nothing.

CEO Jamie Greer, who took the reins in 2023, watched the company grow only to see it unravel under external pressures. These aren’t just business failures, they’re personal tragedies. The real story isn’t just about one chain’s collapse, but about what happens when a fragile system meets an immovable crisis.

A Market That’s Too Crowded to Win

The fried chicken market is hotter than ever, yet survival has never been harder. The global industry is set to nearly double in value by 2035, but that growth isn’t lifting all players. Big names like Chick-fil-A and KFC dominate. Upstarts like Dave’s Hot Chicken are surging. But for every winner, there’s a casualty.

Sticky’s, Raising Cane’s, Zaxby’s, they’re all fighting for the same customers, often on the same street corners. It’s not just about good food anymore. It’s about digital reach, real estate savvy, and capital to burn. For smaller players, it’s a brutal fight with fewer and fewer paths to scale.

Eating Out Is Becoming a Luxury

Dining out is getting more expensive, and more complicated. With restaurant meals averaging $15 to $20, compared to just $4 to $6 for cooking at home, many families are rethinking their habits. Prices rose 3.8% in 2024, yet spending went up, too, suggesting people eat out less often but spend more when they do.

Gen Z wants meals that are Instagram-worthy and health-conscious, while older generations crave value and consistency. The result? A market split between high-end experiences and budget-focused meals, with little room in the middle. For chains like Sticky’s, straddling that divide has become a losing proposition.

If Sticky’s Can Fail, Who’s Really Safe?

Sticky’s story is just one example of how fast success can fade in today’s economy. It’s not about poor decisions or bad food, it’s about a shifting system that no longer rewards quality alone.

From rising costs to changing customer habits, the old rules don’t apply. What’s left is an industry where survival depends on adaptability, capital, and luck. For communities, that means fewer local staples and more uncertainty.

And for workers, it means the promise of stability in hospitality may no longer hold. The question isn’t just who’s next, it’s whether the model itself can still support those trying to build something lasting.

Discover more trending stories and Follow us to keep inspiration flowing to your feed!

Craving more home and lifestyle inspiration? Hit Follow to keep the creativity flowing, and let us know your thoughts in the comments below!