America’s housing foundation is cracking as major lenders retreat at unprecedented speed. JPMorgan Chase, the nation’s largest mortgage lender, cut its portfolio of home loans by 62% since 2021. Wells Fargo has quit correspondent lending entirely. It is not market fluctuation; 935 mortgage products vanished overnight in 2022, and nonbanks now originate 86% of government-backed loans.

The result? It’s a liquidity desert where even credit-worthy buyers must endure Kafkaesque approval processes. Banks were disastrously overexposed when the 2008 crisis struck; now it’s the disaster of underexposure, akin to a vacuum, that destabilizes prices, construction, and generational wealth creation.

The Servicing Time Bomb

Nonbanks now serve 71% of mortgages on razor-thin 0.25% fees while taking on catastrophic liquidity risks. Unlike banks with deposit buffers, these companies must fund missed payments during crises – a vulnerability revealed during the COVID-19 forbearance period.

With an 83% decline in refinancings since 2021, their revenue model relies on unpredictable purchase markets. A single rate spike can cause servicer failures, locking up foreclosure processes and leaving millions in legal limbo. This underlying infrastructure risk renders 2008’s MBS crisis simple in comparison.

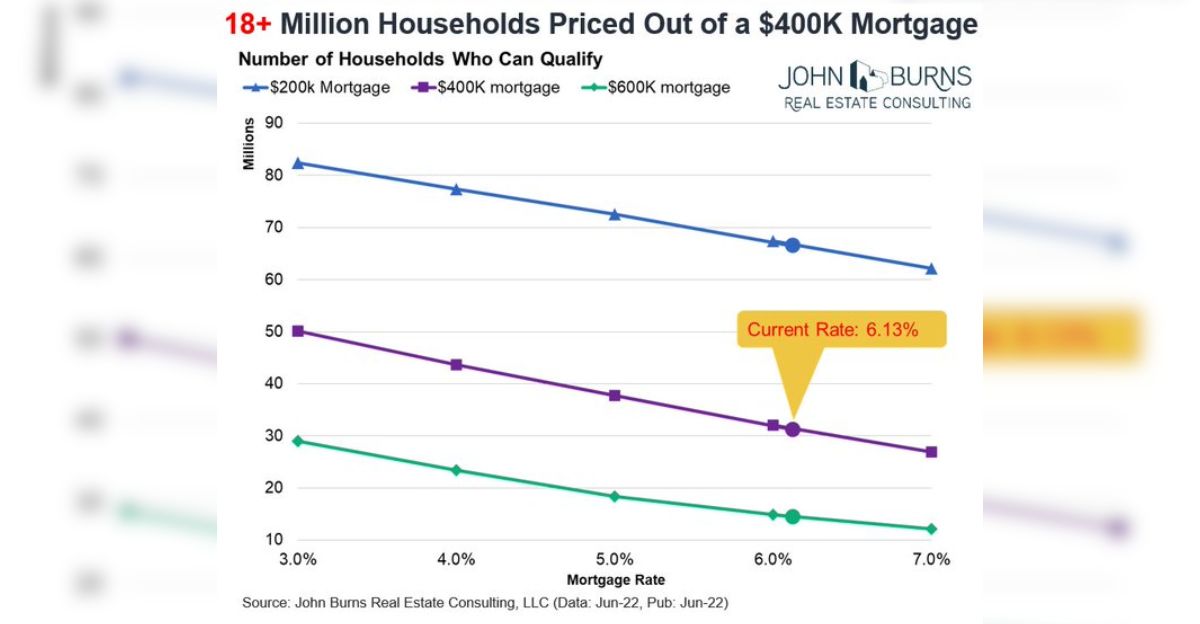

Affordability Mirage

While the headlines trumpet “slowing price growth,” reality bites: real (inflation-adjusted) home prices rose 1.02% year over year on 6.7% mortgage rates. The median household now devotes 35% of its income to payments versus 29% pre-pandemic.

Builders’ strategic 4-6% price cuts barely offset rate impacts, so it’s an affordability treadmill. But there’s a bigger problem: A 3.8M housing deficit means artificial scarcity prices remain high even when demand collapses. It’s not a correction; it’s a market failure in slow motion.

Capital Flights Offshore

Purchasers from abroad, also an essential marginal demand, fled US housing in hyperdrive. Foreign purchases tumbled 36.5% YoY to 54,300 properties, the lowest since tracking began in 2009.

The dollar’s strength contributed to unaffordability, and international tensions routed capital to Dubai and Singapore. The loss of this source of $ 30 B+ in demand each year overwhelmingly impacts luxury markets and new construction projects, which rely on presales.

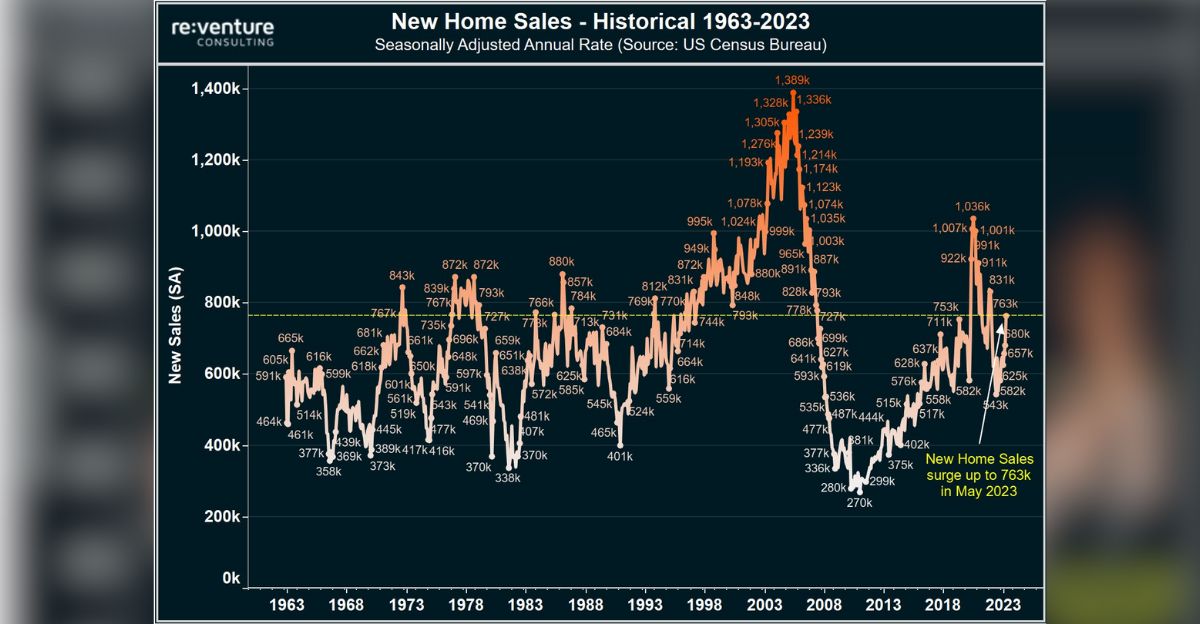

Construction Cliff Dive

Builders aren’t just treading water- they’re eroding future supply. Economists expect housing starts to decline by 2.7% to 1.33 million units in 2025, exacerbating the shortage. The NAHB Confidence Index bottomed at 34, an indication of industry immobility.

Tariffs on Chinese materials and NIMBY permitting delays exacerbate labor shortages, creating a “perfect storm” for extended undersupply. Each delayed start today is suitable for 12-18 months before market delivery, which means that 2026-2027 shortages are virtually assured, regardless of shifts in demand.

The Mobility Crisis

Residential mobility hit historic lows, freezing labor market adjustments. Workers can’t relocate for jobs due to the 3% mortgage rate “golden handcuffs,” creating economic rigidity. This silent crisis reduces GDP growth by 0.5% annually while inflating regional wage disparities

The result? A self-reinforcing cycle where immobility suppresses productivity, depresses homebuilding, and deepens immobility.

The Self-Destructive Impact of Excessive Rules

Basel III capital needs pushed banks to supply six times more capital per mortgage than pre-2008, rendering lending economically unsustainable. Under new regulations, JPMorgan’s mortgage ROE dropped to 4% from 15%, below their 10% hurdle rate.

Instead of remedying this, regulators pushed risk onto shadowy nonbanks with one-tenth the capital cushions. The system now has neither stability nor accessibility—only systemic riskiness.

The Starting Point for Contrarian Thinking

While Sun Belt markets flounder, Midwest industrial cities present surreal opportunities. Cleveland and Detroit now have 4.1% cap rates vs. 3.2% national average, with 40% lower price-to-income ratios.

These markets avoided speculative excess, offering cash-flow positive rentals even at 7% rates. Savvy investors quietly acquire distressed multifamily assets, betting on reshoring-driven job growth.

The Upcoming Pressure on Jumbo

Banks continue to control jumbo loans (72% market share), but increased defaults in wealthier coastal markets challenge this final bastion. San Francisco jumbo delinquencies doubled YoY in Q1 2025, signaling tightening credit.

Should jumbo liquidity evaporate, $ 1.5 M+ home markets might experience 15-20% price falls, pulling comps across the country down.

No Chance for a Soft Landing

It is not a cycle down but a structural failure in the market. With lenders MIA, builders hobbled, and households trapped, nothing will restart the housing engine. Solutions require radical moves: Basel carveouts for mortgages, federal land banks for builders, and 40-year loan terms.

Without such intervention, housing will remain a bifurcated nightmare, unaffordable for families yet unprofitable for capital. They’re not delaying the American Dream, they’re dismantling it, beam by beam.

Discover more trending stories and Follow us to keep inspiration flowing to your feed!

Craving more home and lifestyle inspiration? Hit Follow to keep the creativity flowing, and let us know your thoughts in the comments below!