In recent months, tariffs have changed the economy and many companies have had to pivot quickly to keep their costs at a minimum. As the U.S. puts heft taxes on imports from China, Canada, and Mexico, local companies are now facing higher costs than ever to get their products into the hands of their consumers.

With companies facing higher costs, rather than absorbing them, many are increasing the prices for their products, essentially putting the burden of tariffs on the consumer. Here are some companies that are doing this and two that aren’t.

General Motors

General Motors import a lot of their materials in car manufacturing from Canada. This means that even though many vehicles are made locally, there is still a 25% tariff on components like steel and aluminum. With the cost of materials being raised significantly, General Motors was faced with a dilemma.

The company ultimately resorted to raising the cost of vehicles to keep profit margins the same. This means that any vehicles that customers are buying from GM will be less affordable, leading many to look for alternatives such as the secondhand car market.

Ford

Just like General Motors, Ford sources many of their parts from across America, including Canada and Mexico, which are both tariffed countries. This 25% tariff means that it costs more to produce the vehicles, and the only way to keep profits high is to raise the prices of their vehicles. This showcases that many companies cannot afford to absorb the entirety of the tariffs, or their future could be in jeopardy.

While many manufacturers are scrambling to move production or supply chains to lower-tariff countries, the reality is that it would be a monumental investment of resources.

Tesla

While many Americans might think that Teslas are domestic and independently made, the reality is that electronic vehicles need many imported parts from the highest tariffed region – China. Tesla relies on AI chips and lithium-ion batteries to produce their electric cars, which means that EVs will increase in price as tariffs hit the company.

Many domestic manufacturers build their vehicles in America, but car parts are usually sourced in the most cost effective regions, making the price of the vehicle overall lower. However, as tariffs disrupt these supply chains and make imported parts far more expensive, companies need to factor in the cost somewhere, and it’s usually on the consumer.

Five Below

Moving on from vehicles to retailers, Five Below has a reputation for affordable goods, but in the face of tariffs, it has had to halt its imports from China as the taxation rises to an unprecedented amount.

The company is faced with difficult roads ahead as it needs to adjust its supply chains in order to keep goods affordable. In the short term, however, the retailer has increased the price of items due to the tariffs, sourcing about 60% of its goods from the country.

Nike

Nike is a global manufacturer of iconic athletic wear, but when it comes to the domestic market, prices are only going to get higher due to the increased tariffs. About 70% of Nike’s footwear and other merchandise are imported from countries like China and Vietnam. Prices have also increased due to an increase in raw materials and labor costs.

This means that on average, its products have gone up around 5% to 7%. The CEO of Nike has stated that with all of these pressures, the company can’t afford to absorb all of the costs, meaning that some will ultimately go to the consumer.

Levi’s

Levi’s is a popular American clothing brand that is most well-known for its jeans. Levi’s has already increased the costs of their products in the past due to tariffs, but with the recent wave, around $10 is being added to a normal pair of jeans.

Levi’s wants to reassure the public that the increase in price is only a temporary measure, but if tariffs don’t improve, the company could be forced to keep the costs on the consumers. A lot of the company’s cotton and jeans are imported from tariffed countries like Mexico and China.

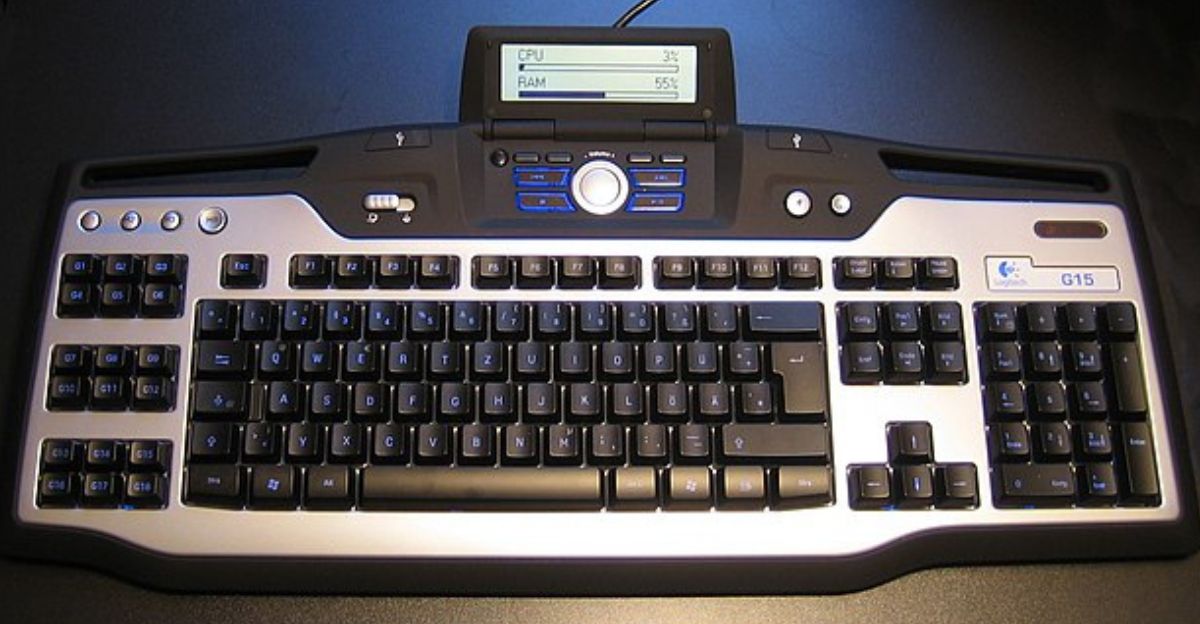

Logitech

Logitech is a renowned brand for making high-quality computer peripherals, from keyboards to mice and headsets. Around 40% of the sales made in the U.S. are imported from China, meaning that tariffs have increased the cost of these items substantially. To try to keep prices as low as possible, Logitech is moving some of its production to Southeast Asia, where tariffs are not as much of a concern.

Even with these measures, the price of more than half of Logitech products has gone up anywhere from 10% to 25%. This showcases how much of a problem unexpected tariffs can be, even for companies that are trying to pivot production elsewhere.

Costco

Amid companies raising the prices of their products, there are others who are dramatically changing supply chains and production locations while also absorbing additional costs to ensure that customers aren’t affected.

Costco has ensured that most of its products will not see an increase in price despite recent tariffs. Although these pivots of production and supply chains are expensive in the short term, they will ensure future prices stay competitive and largely aren’t affected by any future tariffs.

Target

Targe is another retail giant that has decided to absorb a lot of the higher costs of imported items due to tariffs. This approach means that products in the short term shouldn’t dramatically change in price, although there are also risks.

Target’s profit margins shrank substantially in 2025 after high tariffs increased the cost of many of its products. This practice is admirable, but if long-term solutions can now be made, Target won’t be able to absorb the costs forever and will have to put the increased costs on consumers or risk taking a significant financial hit.

Discover more trending stories and Follow us to keep inspiration flowing to your feed!

Craving more home and lifestyle inspiration? Hit Follow to keep the creativity flowing, and let us know your thoughts in the comments below!