Food supply chains still face many challenges, and while the U.S. food system remains resilient overall, certain staples are already seeing cost spikes and could face regional shortages or reduced stock on shelves by month’s end. Weather patterns, transportation costs, global trade shifts, and new tariffs are all creating pressures that shoppers may notice by month’s end.

Although the USDA hasn’t declared a nationwide disruption, analysts note certain categories are already showing stress that could lead to localized shortages by month’s end.

Rather than predicting imminent shortages, it’s more accurate to understand the ongoing pressures and how they’re being managed. Based on proven data, let’s look at what’s happening with specific products.

1. Canned Beans

Distributors warn that if summer weather disrupts legume harvests, shelves could thin in some regions, especially as rising transport costs amplify local supply pressures.

For now, canned beans remain widely available with normal inventory turnover, but consumers could see price bumps or temporary gaps in coming weeks.

2. Pasta

Global wheat price volatility means specialty and imported pastas could sell out faster in certain markets. Domestic pasta plants continue operating at normal capacity, so most common varieties remain in stock, though prices may rise.

3. Cooking Oils

Importers are warning of possible short-term shortages in sunflower and palm oils if demand surges, as global crop pressures mount. U.S. supplies of canola and soybean oil remain steady, but higher commodity costs are already pushing retail prices up.

4. Breakfast Cereals

Some retailers expect gaps in niche or seasonal cereals due to rising packaging costs and streamlined product lines. Larger brands continue regular production, but a sudden uptick in grain or material costs could lead to spotty availability in some areas.

5. Peanut Butter

If peanut yields fall short of forecasts, some stores may ration promotions to avoid running out. For now, production and inventory remain stable, but prices could climb if the harvest is weaker than expected.

6. Frozen Fruit

Weather issues in exporting countries could squeeze supply despite year-round sourcing from multiple regions. Retailers still stock a wide variety of frozen fruit, but isolated shortages or price hikes are possible later in the summer.

7. All-Purpose Flour

Regional mill slowdowns tied to energy costs could briefly affect store stocks, particularly at smaller chains. Domestic wheat farming and milling remain robust overall, so most shortages would likely be temporary.

8. Yogurt Products

Brands warn that specialty and imported yogurts may see sporadic gaps as packaging and ingredient costs climb. Standard varieties remain plentiful, but pricing and availability may fluctuate for premium lines.

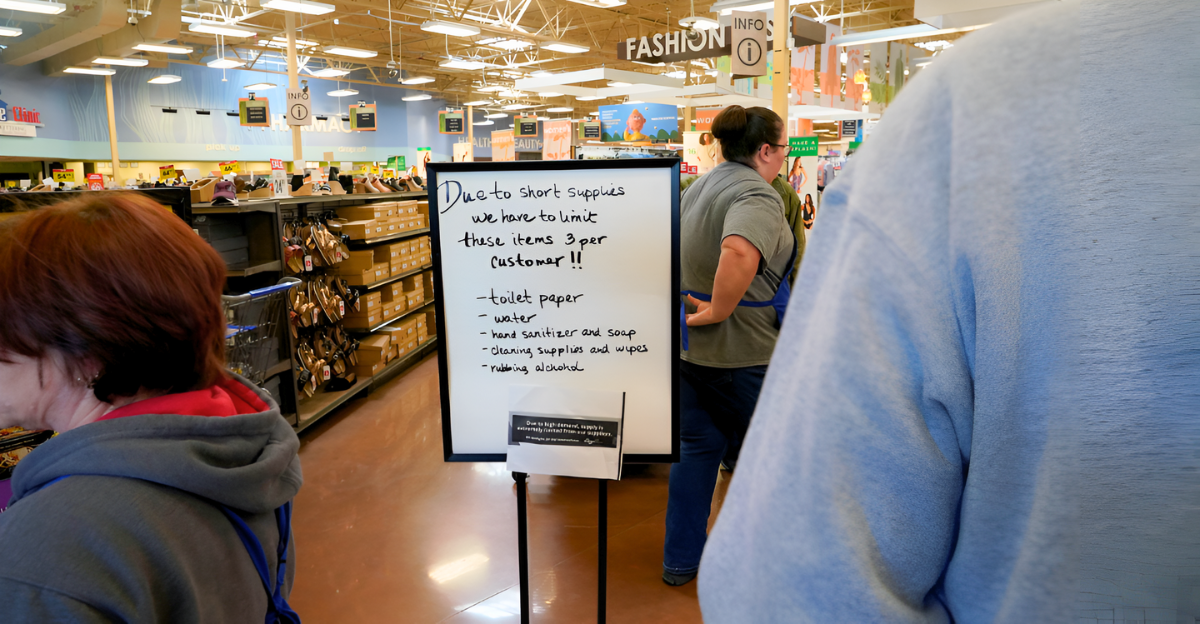

9. Household Paper Products

Paper mills are running at full capacity, leaving little buffer if demand surges. Toilet paper and paper towels are in good supply now, but any buying spike could lead to short-lived outages like those seen in past years.

10. Canned Tomatoes

The expiration of the U.S. suspension agreement on Mexican tomato imports has triggered new tariffs, which may push prices higher and tighten availability later this summer. Domestic production continues, but regional stock gaps are possible as imports slow.

11. Coffee Filters

While production is steady, retailers report occasional sellouts of specific filter sizes as demand fluctuates. Shoppers may need to switch brands or sizes if preferred products run low.

Knowing the Context

Supply chains are under constant pressure from shifting weather patterns, global trade flows and transportation costs.

Yet food firms, distributors, and retailers are managing the challenges. Price volatility is more frequent than widespread shortages, but certain items are facing enough pressure to cause localized gaps in supply.

Practical Shopping Approach

Keep your normal shopping patterns and stay informed about actual conditions, not speculation. Monitor reliable sources like the USDA for verified supply information.

Look into generic or alternative brands if preferred products are temporarily limited. Budget for price fluctuations that reflect commodity market conditions. Remember that temporary variety limitations don’t necessarily imply shortages.